Billionaires Michael and Susan Dell promise $250 to kids in ‘Trump accounts’

Nearly 80% of U.S. children ages 10 and under are slated to receive a $250 gift — placed into an interest-bearing account until they reach adulthood — from tech billionaire couple Michael and Susan Dell, who announced their massive donation this week.

The money will go to kids in this age group who were born before Jan. 1, 2025, as long as they live in a ZIP code with an annual median household income of less than $150,000.

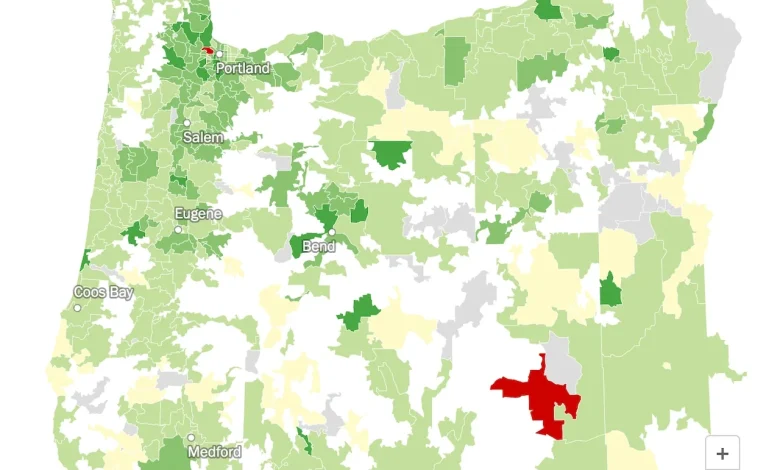

The Oregonian/OregonLive mapped 431 populated Oregon ZIP codes and found that nearly every one of them will meet that threshold, according to the latest figures available.

It appears children in only two ZIP codes clearly won’t qualify for the cash.

That’s 97229, which is north of U.S. 26 in unincorporated Multnomah and Washington counties and includes the Bethany and Forest Heights neighborhoods. Its 75,000 residents had a median household income of about $160,000.

And that’s 97736, where the median household income was $182,000. The ZIP code is in southeast Oregon, at the base of the Steens Mountains. But with just 86 people living there, it’s possible the figure was skewed by a small number of households.

It may also come as a surprise to many Oregonians that ZIP codes encompassing some of the state’s wealthiest communities — including Lake Oswego, West Linn, Dunthorpe and Bend — had median household incomes below the $150,000 mark, meaning children living there could qualify for the $250 gift.

But the details are not yet clear on precisely which communities will be eligible and which will not. That is because it’s unknown exactly which income data set the Dells will use to hand out the money. The Oregonian/OregonLive used the latest and best available data to map ZIP codes by income across the state: Averages compiled by the U.S. Census Bureau’s American Community Survey from 2019 to 2023.

It’s conceivable that one Lake Oswego ZIP code, in particular — 97034 with a median household income of $147,688 — and West Linn’s ZIP code — 97068 with a median household income of $145,877 — will end up exceeding the cutoff for the money, given the past few years of inflation.

That also may hold true for 97221, which encompasses the west hills next to the Oregon Zoo and southwest of it, where income stood at $146,017.

Josh Lehner, Oregon’s former state economist who now works for SGH Macro Advisors, said so much of Oregon falls below the $150,000 income threshold because the state has far more economic diversity within ZIP codes than a number of other parts of the nation. That means very wealthy people may be living in the same ZIP code as low income people.

“So it doesn’t surprise me that a higher share of local zip codes meet the definition than nationally,” Lehner wrote in an email to The Oregonian/OregonLive.

A broad range of incomes exists in 97201, 97205 and 97210 — historic neighborhoods in Northwest and Southwest Portland. These ZIP codes contain multimillion dollar luxury homes, some modest condos and subsidized apartments for low-income earners immediately in and around downtown Portland.

That’s also why the money may go to affluent children — of high-tech professionals, Nike executives or even a Portland Trail Blazer.

David Rothwell, an associate professor at Oregon State University who studies poverty and inequality, said the idea that the Dells are acting upon has been talked about for the past few decades. It’s also been rolled out on much smaller scales and studied.

He said the investment accounts for children can have impact for the many people who are “living paycheck to paycheck, month to month.”

“When kids have these accounts, it may change how they think about their futures,” said Rothwell, who also is the Barbara E. Knudson endowed chair in family policy at OSU.

Rothwell said there are two primary approaches: Give the money to those in greatest need or to everyone. The latter strategy combats stigma and arguments over fairness.

Rothwell said giving the money universally or almost universally — in the case of the Dells — also is easier to administer. Children can be vetted relatively easily by ZIP code.

In order to qualify for the $250 gift, a child must have a Social Security number. Parents also must open a “Trump Account” starting in 2026, with instructions on how to do this expected to come in future months. The money could appear in the accounts in 2026, though exact details haven’t been shared. Parents, relatives and employers are also welcome to contribute to the interest-bearing accounts, which are meant to give children a boost in life when they turn 18 to pay for college, trade school or a house.

And if you’re wondering whether your baby — born on or after Jan. 1, 2025, which is after the cutoff for the $250 gift — is going to miss out, the answer is yes. But these babies instead will be eligible to receive a separate $1,000 investment gift from the U.S. government as part of the “One Big Beautiful Bill Act” passed by Congress in July. So will babies born through the end of 2028.

You can read more about the logistics of the Dells’ gift in this Q&A here.