Will Abbott’s plan to end property taxes for schools work?

Audio recording is automated for accessibility. Humans wrote and edited the story. See our AI policy, and give us feedback.

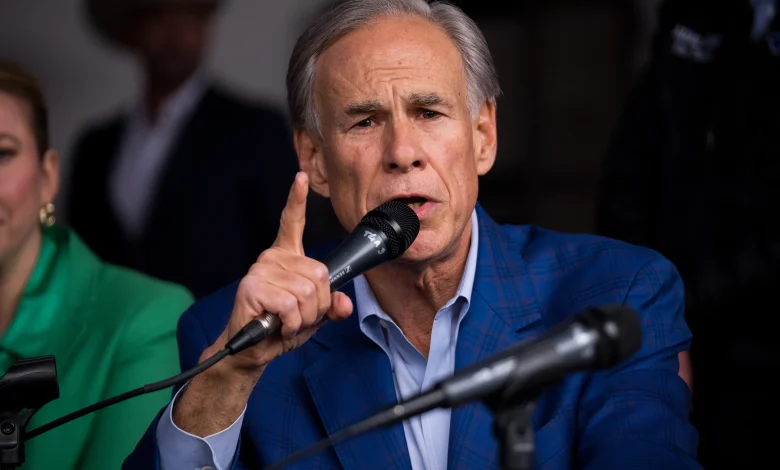

Gov. Greg Abbott announced his reelection campaign in November, promising to lower property taxes. His plan covers three areas, which The Texas Tribune is breaking down over a series of articles. This is Part One.

FORT WORTH — Texas lawmakers have gone big to rein in the state’s property taxes, spending tens of billions of dollars toward reducing the annual bill homeowners and businesses pay each year to help pay for schools. State lawmakers have also put tighter limits on how much local governments can increase taxes to pay for public safety, parks and other services.

Ahead of the 2026 election, Gov. Greg Abbott wants to go bigger.

The three-term governor’s signature proposal is a sweeping property tax-cut platform.

On Abbott’s tax-cut agenda: getting rid of school property taxes for homeowners, putting tighter limits on how much property values can rise and making it tougher for local governments to raise taxes even as their regions boom.

“Every single year, you, my constituents, keep saying our property taxes are too high,” Abbott told a crowd at a campaign event Thursday in Fort Worth, touting the platform. “We have to do more to lower them.”

So far, several Texas House lawmakers have signed on to the platform. Some prominent conservative groups like the Texas Public Policy Foundation and Americans for Prosperity, too, have embraced the plan.

“The governor’s proposals promise to radically improve the tax system’s affordability and predictability by limiting local spending growth, protecting homeownership, and empowering everyday Texans to hold tax cut elections,” said James Quintero, policy director at the conservative Texas Public Policy Foundation’s Taxpayer Protection Project. “With the governor’s plan in place, Texans will finally be able to breathe easy.”

However, tax policy experts spanning the political spectrum are skeptical that Abbott’s pitch is realistic — or would meaningfully bring down the state’s high tax bills.

“This is basically a collection of the worst types of policies meant to constrain property taxes,” Adam Langley, associate director of tax policy at the Lincoln Institute of Land Policy, said of Abbott’s platform. “The negatives here definitely outweigh the positives, and there are a lot of good policy options out there that are missing as well.”

Cutting property taxes has proven a tricky task for state lawmakers. Texas doesn’t levy a statewide property tax. Nonetheless, Texans pay among the highest property taxes in the country, in part because the state doesn’t have an income tax and cities, counties and school districts rely heavily on property taxes to pay for public schools, police officers and firefighters among other public services.

Any of Abbott’s ideas would have to get the green light from lawmakers in the Texas Legislature, where similar ideas have failed. At the very least, tax-cut proponents are treating Abbott’s platform as a conversation starter around how to wrangle the state’s high property taxes.

Have a question about property taxes? Have your property taxes grown or shrunk in recent years? Are you having trouble affording your property taxes? Email Joshua at [email protected].

Eliminating school taxes for homeowners is the cornerstone of Abbott’s proposal — and expensive

Perhaps the most eye-popping proposal in Abbott’s platform: allowing Texas voters to decide whether to abolish school property taxes on homeowners, a goal long pursued by the state’s diehard conservatives.

Abbott says the state is collecting enough revenue to backfill the money schools would no longer collect from homeowners.

School districts have long accounted for the biggest chunk of a given property owner’s tax bill, and state lawmakers have spent billions of dollars in recent years with the intent of driving down homeowners’ school taxes.

In November, Texas voters expanded the state’s homestead exemption, or the amount of a homeowner’s primary residence’s value that can’t be taxed to pay for public schools, from $100,000 to $140,000. Voters approved even bigger breaks for homeowners age 65 and over and those with disabilities.

Such moves have made a dent, but haven’t come close to eliminating school property taxes for most homeowners.

Abolishing property taxes altogether is an idea that’s caught on in conservative circles in recent years as the state boomed and housing costs skyrocketed. But the idea has often run into a brick wall, including from Republicans. One reason why: Doing so would be enormously costly.

Replacing all school property taxes would have cost the state $39.5 billion in tax year 2023 alone, the Legislative Budget Board, a joint legislative committee that helps lawmakers write the state’s budget, said last year. School districts collected more in 2024 to the tune of $42 billion. For comparison, the portion of the state budget paid for with state taxes in tax year 2023 was $58.8 billion.

The state already plans to spend $51 billion over the next two years on school property tax cuts. Those funds will pay for the bump in the homestead exemption as well as targeted cuts for businesses. The state will also send a good portion of those funds to local school districts to replace revenue that otherwise would have been collected via property taxes, with the aim of driving down school districts’ tax rates.

Had those measures been in effect last year, the owner of a typical Texas home, valued at $302,000, according to Zillow, would have saved more than $500 on their 2024 school taxes, according to a Tribune calculation.

But $51 billion is a substantial chunk of money. For every six or seven dollars the state will spend in the next two years, one will be spent on cutting property taxes, a figure that has some budget wonks and even some Republicans worry may not be financially sustainable.

Abolishing school property taxes for homeowners may be part of Abbott’s platform “for the purpose of messaging, but is not a realistic proposal,” said Shannon Halbrook, a fiscal policy expert at Every Texan, a left-leaning policy nonprofit.

Abbott’s proposal would cost less than that because it would only apply to homeowners, the governor said Thursday.

Abbott’s campaign did not provide estimates of how much the proposal would cost. But school districts collected about $17.5 billion in taxes from owners of single-family homes in tax year 2023, according to an analysis by the Texas Taxpayers and Research Association, a business-backed group that lobbies for tax cuts. That figure includes taxes on rental homes, which don’t qualify for homestead exemptions, so they wouldn’t be taken off the tax rolls.

Owners of other property like apartments, stores, factories and warehouses would still have to pay school property taxes — a fact likely to rile business groups.

Abbott says hiking sales taxes to pay for property tax cuts is off the table

A push by Abbott and other GOP officials to drastically hike the state sales tax to pay for property tax cuts in 2019 went down in flames. That proposal, critics argued at the time, would have meant paying for property tax cuts on the backs of lower income Texans, who spend a bigger chunk of their income paying sales taxes than wealthier households.

Texas would have had to more than double the state’s sales tax rate to replace all school property taxes in tax year 2023, another Texas Taxpayers and Research Association calculation found.

Rather than touching the rate, it’s possible state lawmakers could raise the amount of sales tax revenue the state generates by nixing certain exemptions and taxing more services, some experts said. But that would only generate so much revenue, Halbrook said.

“That really picks you up a billion dollars here and there,” Halbrook said. “It would not touch what they’d have to try and make up for if they completely got rid of” taxes that pay to operate and maintain schools, he said.

This time, a sales tax hike is off the table, Abbott said Thursday.

“There’s no reason to raise our sales tax,” Abbott said. “We’ve got the money to reduce … property taxes right now.”

Instead, Abbott said, state lawmakers would tap state budget surpluses to abolish homeowners’ school property taxes.

That’s what state lawmakers have done the past two years to pay for tax cuts, drawing on surpluses created with tens of billions of federal COVID-19 pandemic dollars and higher-than-usual growth in sales taxes fueled by inflation.

But state budget watchers have warned that those surpluses were an anomaly, and as those federal dollars have been spent and sales tax revenue wanes, lawmakers will likely not have as much wiggle room as they did in previous years.

Abbott is undeterred, confident that the state’s continued growth will keep at least some amount of surplus in the mix.

“When you look at our economy and know how diverse our economy is, you know that we’re going to have plenty of money for a long time,” Abbott said.

Abbott has proposed amending the Texas Constitution to get rid of homeowners’ school taxes, a measure voters would have to sign off on at the ballot box. Such a move would be difficult to reverse, and ensure that lawmakers would always have to find money to pay for the cuts.

It’s likely homeowners’ school taxes wouldn’t be completely wiped out right away, Quintero said, and would take years to do away with if voters said so. But voters could theoretically compel lawmakers to keep chipping away at property taxes depending on how the constitutional amendment is worded, he said. For example, it might force lawmakers to put any state surplus toward further cutting homeowners’ property taxes, Quintero said.

Others worry legislators would likely have to cut elsewhere in the budget to continue funding tax cuts if the state’s budget takes a hit as a result of a significant economic downturn.

“In that case, all bets are off,” Halbrook said. “The Legislature can and may choose to cut schools, health care, worker pay, infrastructure or any other items to balance the budget.”

Disclosure: Every Texan, Texas Public Policy Foundation and Texas Taxpayers and Research Association have been financial supporters of The Texas Tribune, a nonprofit, nonpartisan news organization that is funded in part by donations from members, foundations and corporate sponsors. Financial supporters play no role in the Tribune’s journalism. Find a complete list of them here.

![2026 Australian Open: Tien [29th] vs. Shevchenko [97th] Prediction, Odds and Match Preview](https://cdn2.el-balad.com/wp-content/uploads/2026/01/2026-Australian-Open-Tien-29th-vs-Shevchenko-97th-Prediction-Odds-390x220.webp)