Changes to your taxes in 2026: Online, at home and on your paycheque

Listen to this article

Estimated 5 minutes

The audio version of this article is generated by AI-based technology. Mispronunciations can occur. We are working with our partners to continually review and improve the results.

As we enter a new year, politicians at every level of government are promising to make your lives more affordable.

Now’s your chance to decide how they’re doing. Here’s how federal, provincial and municipal taxes will change for residents of Manitoba and Winnipeg in 2026.

Federal tax changes

Basic personal income amount (non-refundable tax credit): Total income under $16,452. This rises $323.

Taxation rate on the first personal income tax bracket: Down one percentage point (from the start of 2025) to 14 per cent. This will save the average Canadian who files a tax return $190, according to the parliamentary budget officer.

First personal income tax bracket (income taxed at 14 per cent): $16,452 to $58,523. The ceiling on this bracket rises $1,148.

Second personal income tax bracket (income taxed at 20.5 per cent): $58,253 to $117,045. The ceiling on this bracket rises $2,295.

Third personal income tax bracket (income taxed at 26 per cent): $117,045 to $181,440. The ceiling on this bracket rises $3,558.

Fourth personal income tax bracket (income taxed at 29 per cent): $181,440 to 258,482. The ceiling on this bracket rises $5,068.

Highest personal income tax bracket (income taxed at 33 per cent): Any income higher than $258,482.

Canada Pension Plan: Maximum pensionable earnings increase by $3,100 to $74,600. This increases the maximum employee and employer contribution for the year by $196.35 to $4,230.45

WATCH | Here’s how your taxes are changing in 2026:

Here’s how your taxes are changing in 2026

CBC Manitoba rounds up the changes to federal, provincial and municipal taxes and fees coming in 2026.

Employment Insurance: The EI tax rate drops 0.01 percentage points to 1.63 per cent, but the maximum insurable amount increases by $3,200 to $68,900.

Industrial carbon tax: On the rise from $95 a tonne to $110 per tonne, though it’s unclear how this will be passed down to consumers.

Consumer carbon tax: Carbon taxes? We ain’t got no carbon taxes. We don’t need no carbon taxes. I don’t have to pay you any stinkin’ carbon taxes.

Manitoba tax and fee changes

Cloud computing tax: Starting on Jan. 1, provincial sales tax will apply to computing services such as internet-based subscriptions to software, data servers and storage, and online platforms that provide tools to develop apps.

Hydro rates: Up four per cent on Jan. 1 in a move that will cost the average Manitoba household that uses electricity only for power an additional $50.40 in 2026, according to Manitoba Hydro. The average household that uses electricity for heating as well as power will pay an additional $96.60, Hydro estimates.

Campground fees: The nightly cost of publicly owned cabin rentals in selected provincial parks will rise in the new year to a range of $45 to $85 from the current $38 to $69. Yurt rentals will increase to $65 a night from $56. There are also nominal fee increases for campsite rentals as well as a new $10 fee for cancelling campsite reservations.

An end to provincial income-tax bracketing: The province will stop sliding income tax thresholds to keep pace with inflation in 2026. The Canadian Taxpayers Federation says the resulting bracket creep will cost Manitobans who file income taxes $82 million next year.

Provincial income tax brackets: The basic basic personal income amount — also known as the non-refundable tax credit — will remain $15,780. Income between $15,780 and $47,000 will continue to be taxed at 10.8 per cent. Income between $47,000 and $100,000 will continue to be taxed at 12.75 per cent. Income over $100,000 will continue to be taxed at 17.4 per cent.

Manitoba Premier Wab Kinew, foreground, and Finance Minister Adrien Sala brought in a budget this spring that calls for the PST to be applied to software subscriptions and data storage, starting Jan. 1. (Bryce Hoye/CBC)

Provincial property taxes (also known as education taxes): The maximum credit rises $100 to $1,600. Since this is the second year of a flat education tax credit, there won’t be anywhere near as many wild fluctuations in the paper property tax bills that present the combined tab for provincial and municipal property taxes.

Credits for renters: Up $50 to $625.

Winnipeg tax and fee changes

Property taxes: Up 3.5 per cent. This hike will add $75 to the municipal portion of a tax bill for a property assessed at $371,000.

Winnipeg Transit: Adult fares up 10 cents to $3.45.

Most city fees: Up 2.5 per cent across the board, with some exceptions. The fee hike in 2025 was five per cent.

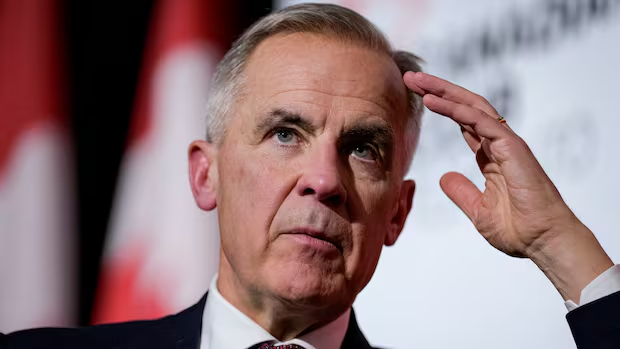

Winnipeg Mayor Scott Gillingham’s fourth budget calls for a 3.5 per cent property tax hike. (Tyson Koschik/CBC)

Waste management fee (for garbage and recycling collection): Up $10 per detached household to $264. For units in multi-family buildings, the fee rises $7 to $134.

Water rate: Up eight cents per cubic metre, to $2.17.

Sewer rate: Up 13 cents per cubic metre, to $4.53.

Sources: City of Winnipeg, province of Manitoba, government of Canada