Apple reportedly finds Apple Card partner to replace Goldman Sachs

Apple has found an Apple Card partner replacement for Goldman Sachs, according to a new Wall Street Journal report. The latest development comes more than two years after Goldman Sachs and Apple were initially reported to part ways.

Citing people familiar with the matter, the WSJ reports that Apple is expected to tap JPMorgan Chase to replace Goldman Sachs as the backer behind Apple’s iPhone-integrated credit card.

Goldman Sachs has reportedly been searching for an exit from its Apple Card deal for more than two years, according to media reports. That’s because the consumer credit card business has been a multi-billion dollar loss for Goldman Sachs.

American Express, Synchrony Financial, and Capital One were previously named as interested parties in replacing Goldman Sachs.

Per the WSJ, JPMorgan Chase will take on existing credit balances at a steep discount.

Goldman Sachs is expected to offload the roughly $20 billion of outstanding card balances at a more than $1 billion discount, according to people familiar with the matter.

With most co-brands, balances sell at a premium of up to 8%, a figure that can run into the double digits for the strongest programs. Discounts are rare and are reserved for the most challenged cases.

Additionally, JPMorgan will back Apple-branded savings accounts, although existing customers may be able to stay with Goldman.

JPMorgan is planning to launch a new Apple savings account, according to people familiar with the matter. Consumers with existing Apple savings accounts at Goldman will decide whether they want to stay there or open an account with JPMorgan, the people said.

The report says the deal is expected to be announced soon. News first broke that Apple and Goldman Sachs were splitting up over Apple Card in November 2023. Apple announced Apple Card in 2019.

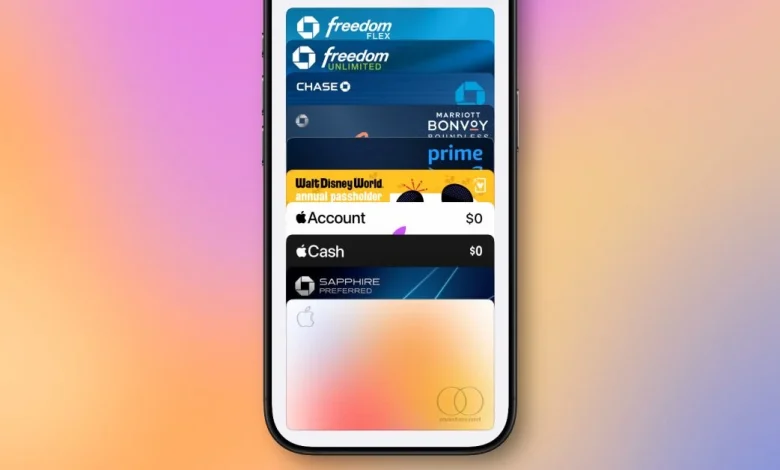

Apple Card, which is only offered in the United States, includes benefits like 3% back on purchases from Apple and select merchants when using Apple Pay, 2% cash back on other purchases with Apple Pay, and deep integration with the Apple Wallet app on iPhone.

Apple Card replaced the company’s previously co-branded card with Barclays, which lacked the titanium credit card and iPhone-based integration.

FTC: We use income earning auto affiliate links. More.