Apple confirms Chase takeover for Apple Card and reveals new details

Apple has confirmed that Chase will become the new issuer of Apple Card, taking over for Goldman Sachs. Apple says the transition will occur “in approximately 24 months.”

“During this transition, Apple Card users can continue to use their card as they normally do,” Apple says. “Additional details regarding the transition will be shared with all Apple Card users as the transition date approaches.”

Apple announced the news in a press release, following a report from The Wall Street Journal earlier today. Here’s Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet:

“We’re incredibly proud of how Apple Card has transformed the credit card experience for customers by delivering innovative tools that empower users to make healthier financial decisions. Chase shares our commitment to innovation and delivering products and services that enhance consumers’ lives. We look forward to working together to continue to provide a best-in-class experience and exceptional customer service with Apple Card.”

Apple has also published a new page on its website with answers to frequently asked questions about Apple Card’s transition to Chase.

Here are some tidbits:

- Existing Apple Card users do not need to reapply.

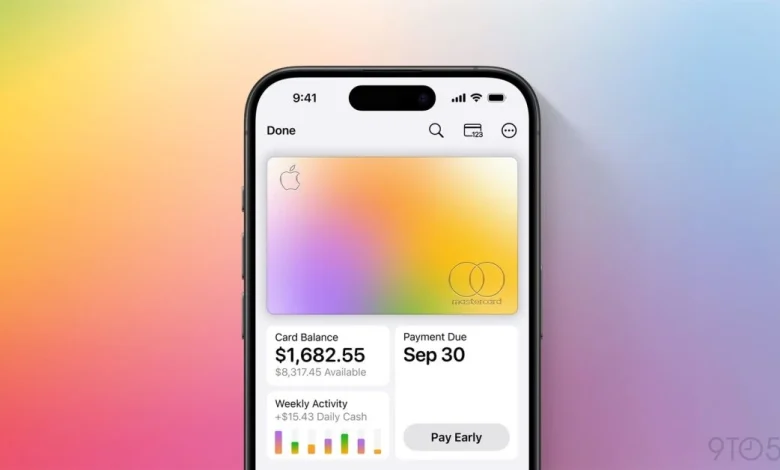

- Mastercard will continue to be the payment network.

- You should continue to pay your balance as you do today. Once the transition is complete, Apple Card balances for open accounts will be with Chase.

- You will continue to have access to Savings.

- Further information regarding Savings will be communicated as the transition date approaches.

- You can continue to manage their Apple Card account in the Wallet app.

- You can continue to use your existing physical Apple Card as normal.

- Any changes or additional information regarding new physical cards will be shared as the transition date approaches.

- You can continue to purchase Apple products with Apple Card Monthly Installments when they choose to check out with ACMI at Apple Store locations, apple.com, and the Apple Store app.

- Apple Card will continue to have no fees: no annual fees, no late fees, no foreign transaction fees.

- Once the transition takes place, your credit reports will update to show Chase as the new issuing bank of Apple Card.

As of right now, Apple says there is nothing Apple Card users need to do to complete the migration to Chase. “Any changes or additional details will be shared directly with Apple Card users as the transition date approaches,” Apple says.

You can find more details on Apple’s website.

CardPointers helps users earn more points everywhere they shop for free. With CardPointers+, most users save $750+ per year — and for a limited time you can save 30% off the normal price. –trusted affiliate link*

My favorite iPhone accessories:

Follow Chance: Threads, Bluesky, Instagram, and Mastodon.

FTC: We use income earning auto affiliate links. More.

![What Gemini features you get with Google AI Pro [Nov 2025]](https://cdn2.el-balad.com/wp-content/uploads/2025/11/What-Gemini-features-you-get-with-Google-AI-Pro-Nov-390x220.webp)