The Steam games that sold the most copies over the holidays

The holidays are over, and 2025 is firmly behind us. So, Happy New Year and all that. Since the last edition of the newsletter, we at Alinea HQ have gained a few kilos and cleared a few games off our Steam backlogs – then instantly added a few more games during the sales.

And plenty of other Steam players have done the same – for the games, not the kilos (hopefully). Let’s get into it.

Last month was Steam’s highest-grossing December yet. Via over 100 million players, Valve’s storefront generated $1.6B dollars in gross revenue last month.

That’s up 22.7% over December 2024 and even more than December 2020’s pandemic-driven high of $1.4B.

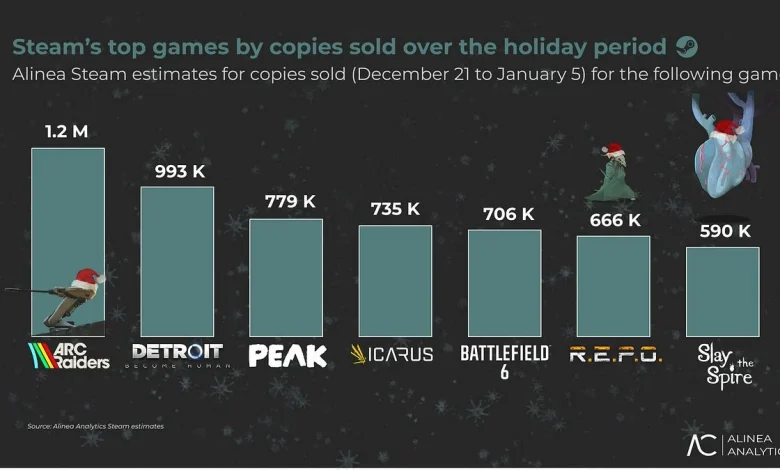

Let’s look at our estimates on the Steam games that shifted the most copies during two of the most critical holiday weeks.

ARC Raiders, whose success we covered here, was the clear #1 by copies sold in the two weeks between Dec 21 and Jan 4, extracting another 1.2M copies.

It seems like the brakes are broken on the ARC Raiders train. The momentum just keeps on building, and the holidays and discounts helped it shatter new milestones:

-

ARC passed 12M copies sold overall over the weekend, and it reached 7M copies sold on Steam yesterday.

-

Daily copies sold had started to stabilise a bit by early December, but a well-timed 20% discount across all platforms – as well as the holiday engagement boost – quickly reversed that.

-

ARC sold 250K copies on Boxing Day alone. Embark is attracting new players but also retaining old ones through some meaningful updates over the winter. Sunday marked ARC’s highest DAU count to date – and across every platform too. Almost 3.2M played (53% via Steam).

ARC was the #2 Steam game by revenues between Dec 21 and Jan 4, though, generating another $32 million. Counter-Strike 2 took #1, as it usually does.

Looking for revenue data? We have that in our platform. Get a trial here.

As for the rest of the ranking for Steam copies sold between Dec 21 and Jan 4:

-

Detroit: Become Human (#2), the sci-fi interactive story from Quantic Dream, shifted 993K copies, thanks to a steep discount to $4 (down from $40) that ran between December 18 and yesterday, the end of the Steam Winter Sale. This was Detroit’s deepest discount since it was ported to Steam in 2020, beating the previous low of $8. Given the low price, revenues amounted to just $3.2 million, still helping Detroit pass $150 million in Steam revenues and 7M Steam copies sold overall during the two weeks. 5% of those players have wishlisted Dispatch.

-

PEAK (#3), the chaotic co-op climbing caper, continued to climb. It shifted another 779K copies in the two weeks to cross 16M sold on Steam overall. The wheels are still turning on PEAK’s clever pricing strategy, which we outlined in detail here.

-

Icarus (#4) sold 735K, also thanks to its sharpest discount yet, from $35 to $3 – too, part of the Steam Winter Sale. The open-world survival title was made by Dean Hall (DayZ’s creator) and has fostered a strong Steam community since launching four years ago. The discount helped Icarus soar past 3.5M copies sold on Steam. While the US is its top market, the title also resonates in emergent markets like Russia (its #2 market) and Brazil (#3). Icarus is due to spread its wings onto consoles this quarter.

Indies, AAA, old, and new. You love to see it.

-

Battlefield 6 (#5) has continued to sell well over the two weeks, with another 706K on Steam. This was also thanks to a -30% discount to $49, which converted some on-the-fence wishlisters. While free-to-play REDSEC hasn’t really made the dent EA wanted, the core BF6 experience is keeping the momentum going for Vince Zampella’s swan song. Rest in peace, Vince. You were one of the very best. Shifting gears a bit…

-

R.E.P.O. (#6) sold a fittingly demonic 666K copies in the two-week period, bringing its overall copies sold number spookily close to 20M. Again, this co-op horror title’s sporadic sales keep bringing it back into the Steam charts, which you can see in the Alinea Platform screenshot below. We track the daily prices of games on Steam, PlayStation, and Xbox every day for our platform clients (nab a demo and trial here).

Pricing analysis is a cinch with our platform. Look out, your competitors. Free trial?

Then finally, we’ve got Slay the Spire at #7 with 590 K in the two-week period. This helped the deck-building masterpiece ascend to 9M+ copies sold on Steam overall.

Again, Slay the Spire had its lowest-ever price as part of the Steam Winter Sale, down from $25 to just $2. That’s a third of its previous lowest price of $6.

This discount is well-timed. Slay the Spire II is in development, and we’re expecting an announcement soon ahead of the planned March early-access release.

Can’t. Bloody. Wait.

One takeaway from the numbers we’ve looked at today is the synergy between holiday spending and freer time, which obviously creates a psychological state where players are actively looking to commit to a new experience.

When a well-timed discount hits during this window, it lowers the barrier for on-the-fence consumers.

Whether it’s a 20% trim for a powerhouse like ARC Raiders to maintain momentum or a 90% historical low for a classic like Detroit: Become Human, these price points capitalise on a rare moment: players actually having bandwidth to start something fresh.

Discounting can also be a tactical precursor to future growth. For Slay the Spire, the extra $1.2M in revenue in those two weeks was lush, but the discount was more about aggressively expanding the install base and refreshing the brand’s mindshare just months before the sequel hits early access.

Same goes for Icarus and its upcoming console ports.

This sequel- and port-seeding strategy, combined with the conversion of long-term wishlisters for heavy hitters, proves that the holidays are an ample time to transform passive interest into fandom.

Reply to this email – or reach out here – if you have any feedback for the newsletter – or want to request a game for us to cover.

[Alinea Analytics boasts the most accurate PC and console estimates in the business. Game makers use our platform to understand their audience, keep an eye on the competition, monitor sales trends, and spot new opportunities. We equip game studios and financial institutions with accurate data and the confidence to make smarter, data-driven decisions. Want to talk about all things games market data? We’d love to chat!]