Bitmine Immersion Technologies (BMNR) Announces ETH Holdings Reach 4.285 Million Tokens, and Total Crypto and Total Cash Holdings of $10.7 Billion

As of February 1st, 2026 at 6:00pm ET, the Company’s crypto holdings are comprised of 4,285,125 ETH at $2,317 per ETH (Coinbase), 193 Bitcoin (BTC), $200 million stake in Beast Industries, $20 million stake in Eightco Holdings (NASDAQ: ORBS) (“moonshots”) and total cash of $586 million. Bitmine’s ETH holdings are 3.55% of the ETH supply (of 120.7 million ETH).

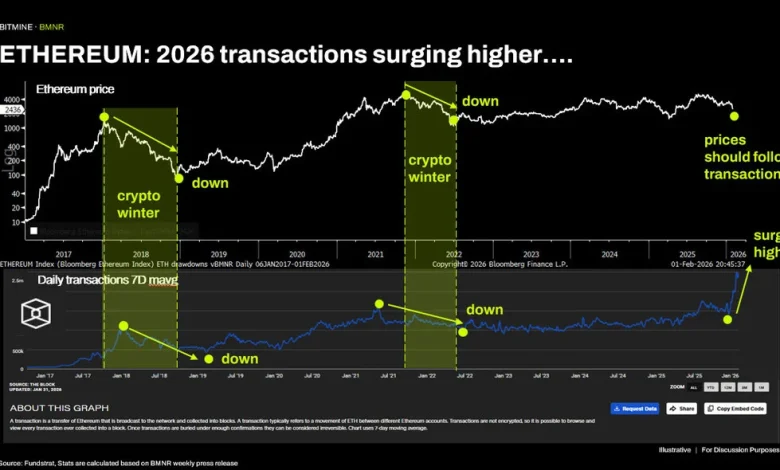

“ETH prices have dropped sharply in the past month from ~$3,000 to ~$2,300. This occurred while Ethereum daily transactions hit an all-time high (ATH) of 2.5mm (per theblock.co) and active addresses soared in 2026 to an ATH to 1 million daily (per theblock.co). In other words, Ethereum on-chain activity and fundamentals have grown solidly in the past few months, but ETH prices have declined. During the crypto winter of 2021-2022 or 2018-2019, Ethereum transaction activity and active wallets declined, which is counter to what we have seen in the past 12 months,” said Thomas “Tom” Lee, Executive Chairman of Bitmine.

“Thus, non-fundamental factors are arguably more the factors explaining the weakness in ETH prices. Foremost, in our view, is that leverage has not returned yet to crypto as the October 10th ripple effects continue. The second factor is the surge in precious metals prices, which have acted as a ‘vortex’ sucking away risk appetite from crypto. That said, Gold seems to be following 1979-1980 closely. What confirmed the top in January 1980 was a -13% daily decline on January 22, 1980. On January 30, 2026, Gold fell -9%, its 4th largest ever daily decline. Each of the prior 3 larger declines marked a near-term top,” said Lee.

“In the past week, we acquired 41,788 ETH,” continued Lee. “Bitmine has been steadily buying Ethereum, as we view this pullback as attractive, given the strengthening fundamentals. In our view, the price of ETH is not reflective of the high utility of ETH and its role as the future of finance.”

As of February 1, 2026, Bitmine total staked ETH stands at 2,897,459 ($6.7 billion at $2,317 per ETH). This is an increase of 888,192 in the past week. “Bitmine has staked more ETH than other entities in the world. At scale (when Bitmine’s ETH is fully staked by MAVAN and its staking partners), the ETH staking rewards is $374 million annually (using 2.81% CESR), or greater than $1 million per day,” stated Lee.

“Annualized staking revenues are now $188 million, up +18% in the past week (see chart). And this 2.9 million ETH is about 67% of the 4.3 million ETH held by Bitmine. The CESR (Composite Ethereum Staking Rate, administered by Quatrefoil) is 2.81%. We continue to make progress on our staking solution known as The Made in America VAlidator Network (MAVAN). This will be the ‘best-in-class’ solution offering secure staking infrastructure and will be deployed in early calendar 2026. Bitmine is currently working with 3 staking providers as the Company moves towards unveiling MAVAN in 2026,” continued Lee.

Bitmine crypto holding reigns as the #1 Ethereum treasury and #2 global treasury, behind Strategy Inc. (NASDAQ: MSTR), which owns 712,647 BTC valued at $55 billion. Bitmine remains the largest ETH treasury in the world.

Bitmine is one of the most widely traded stocks in the US. According to data from Fundstrat, the stock has traded average daily dollar volume of $1.1 billion (5-day average, as of January 30, 2026), ranking #105 in the US, behind Schlumberger NV (rank #104) and ahead of Humana (rank #106) among 5,704 US-listed stocks (statista.com and Fundstrat research).

The GENIUS Act and Securities and Exchange Commission’s (“the SEC”) Project Crypto are as transformational to financial services in 2025 as US action on August 15, 1971 ending Bretton Woods and the USD on the gold standard 54 years ago. This 1971 event was the catalyst for the modernization of Wall Street, creating the iconic Wall Street titans and financial and payment rails of today. These proved to be better investments than gold.

The Chairman’s message can be found here:

https://www.bitminetech.io/chairmans-message

The Fiscal Full Year 2025 Earnings presentation and corporate presentation can be found here: https://bitminetech.io/investor-relations/

Select images from Bitmine’s Annual Meeting can be found here.

To stay informed, please sign up at: https://bitminetech.io/contact-us/

About Bitmine

Bitmine (NYSE AMERICAN: BMNR) is the leading Ethereum Treasury company in the world, implementing an innovative digital asset strategy for institutional investors and public market participants. Guided by its philosophy of “the alchemy of 5%,” the Company is committed to ETH as its primary treasury reserve asset, leveraging native protocol-level activities including staking and decentralized finance mechanisms. The Company will launch MAVAN (Made-in America VAlidator Network), a dedicated staking infrastructure for Bitmine assets, in Q1 of 2026.

For additional details, follow on X:

https://x.com/bitmnr

https://x.com/fundstrat

https://x.com/bmnrintern

Forward Looking Statements

This press release contains statements that constitute “forward-looking statements.” The statements in this press release that are not purely historical are forward-looking statements which involve risks and uncertainties. This document specifically contains forward-looking statements regarding progress and achievement of the Company’s goals regarding ETH acquisition and staking, the long-term value of Ethereum, continued growth and advancement of the Company’s Ethereum treasury strategy and the applicable benefits to the Company. In evaluating these forward-looking statements, you should consider various factors, including Bitmine’s ability to keep pace with new technology and changing market needs; Bitmine’s ability to finance its current business, Ethereum treasury operations and proposed future business; the competitive environment of Bitmine’s business; and the future value of Bitcoin and Ethereum. Actual future performance outcomes and results may differ materially from those expressed in forward-looking statements. Forward-looking statements are subject to numerous conditions, many of which are beyond Bitmine’s control, including those set forth in the Risk Factors section of Bitmine’s Form 10-K filed with the SEC on November 21, 2025, as well as all other SEC filings, as amended or updated from time to time. Copies of Bitmine’s filings with the SEC are available on the SEC’s website at www.sec.gov. Bitmine undertakes no obligation to update these statements for revisions or changes after the date of this release, except as required by law.

SOURCE BitMine Immersion Technologies, Inc.