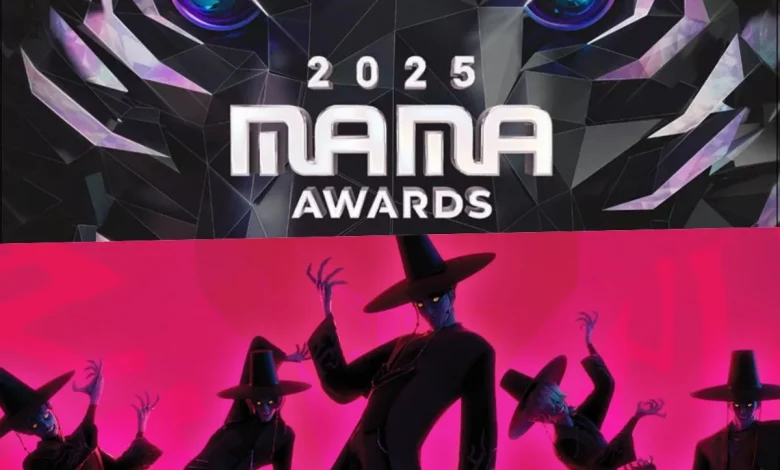

2025 MAMA Awards Saja Boys Collab Performance Officially Canceled

The special Saja Boys collaboration performance that was scheduled for Day 2 of the 2025 MAMA Awards has officially been canceled.

On November 29, KOZ Entertainment announced, “Due to the scaling down of the 2025 MAMA Awards, [BOYNEXTDOOR] will no longer be participating in the performance that was scheduled for today. We ask for fans’ generous understanding.”

PLEDIS Entertainment similarly announced, “[TWS] will not be participating in the performance that was scheduled for today.”

As both BOYNEXTDOOR and TWS already attended Day 1 of the 2025 MAMA Awards on November 28, the announcements are a clear reference to the special “KPop Demon Hunters” collaboration performance of Saja Boys’ “Your Idol” that was originally scheduled to take place at the ceremony on November 29.

The lineup for the now-canceled performance consisted of BOYNEXTDOOR’s Leehan, RIIZE’s Wonbin, TWS’s Shinyu, and ZEROBASEONE’s Park Gun Wook and Han Yu Jin.

Due to the tragic fire in Hong Kong, numerous changes have been made to the 2025 MAMA Awards, including the cancellation of the red carpet event before the show.

Once again, our thoughts and prayers go out to everyone who has been affected by the tragedy.

Source (1)