Should You Buy the 3 Highest-Paying Dividend Stocks in the Dow Jones?

With yields between 3.4% and 6.8%, you’ll need to think carefully about the highest yields in the Dow before you buy them.

Just because a stock offers a high yield does not mean it is a good investment. You need to understand the business that backs the yield. And, perhaps even more importantly, ensure that the investment aligns with your needs and portfolio. So, don’t just hit the buy button as you look at the highest-yielding stocks in the Dow Jones Industrial Average; get to know them a little.

To get you started, here’s a quick primer on Verizon Communications (VZ +1.04%) and its 6.8% yield, Chevron (CVX 1.48%) and its 4.6% yield, and Merck (MRK 1.16%) and its 3.4% yield.

Verizon has to keep up the capex

At its core, Verizon’s telecom business produces annuity-like income streams. That’s because customers tend to choose a provider and then stick with it for years. That’s good news and could make the stock an attractive investment choice for more conservative investors. However, the lofty 6.8% hints at some potential risks.

Today’s Change

(1.04%) $0.43

Current Price

$41.69

Key Data Points

Market Cap

$176B

Day’s Range

$41.24 – $42.05

52wk Range

$37.59 – $47.35

Volume

48K

Avg Vol

27M

Gross Margin

46.08%

Dividend Yield

6.53%

For example, Verizon carries a material amount of debt. That’s not shocking, given the capital-intensive nature of running its telecom networks. That said, the networks require constant capital investment to keep pace with the company’s competitors.

The end result is that Verizon hasn’t had a lot of cash left behind to support its dividend growth, which has averaged just 2% a year or so on an annualized basis over the past decade. That’s slower than the historical growth rate of inflation, meaning the buying power of the dividend has been declining.

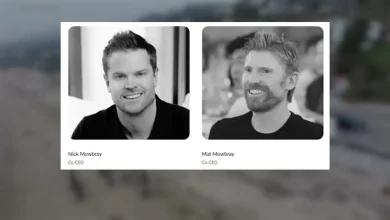

The company has just brought in a new CEO to help improve its growth prospects, which sounds promising but also comes with risks. Execution will be crucial for any new plan that is created. And dividend lovers need to recognize that new CEOs with new business plans sometimes cut dividends.

There’s probably no need to rush out to buy Verizon, so a wait-and-see attitude with the leadership transition is probably advisable.

Image source: Getty Images.

Chevron is a survivor

The story around energy industry giant Chevron is far more compelling. For starters, the dividend has been increased annually for 37 consecutive years. That is an amazing number, given the inherent volatility of the commodity-driven energy sector. That streak didn’t happen by accident, however, because Chevron is built to survive the industry’s swings.

That starts with the company’s integrated business model, which means it operates in the upstream (energy production), the midstream (pipelines), and the downstream (chemical and refining). This diversification helps to soften the ups and downs of the industry, as each sector performs a little differently throughout the energy cycle.

On top of that, Chevron has a rock-solid balance sheet, with a debt-to-equity ratio of just 0.22. That gives management the flexibility to take on debt during the hard times so it can keep funding its business and dividend. When good times return, as they always have historically, leverage is reduced in preparation for the next energy downturn.

Today’s Change

(-1.48%) $-2.26

Current Price

$150.00

Key Data Points

Market Cap

$302B

Day’s Range

$149.83 – $152.63

52wk Range

$132.04 – $168.96

Volume

25K

Avg Vol

7.6M

Gross Margin

13.60%

Dividend Yield

4.56%

Chevron can’t completely avoid the energy sector’s volatility. However, it has proven very adept at paying investors well as it rides the peaks and valleys. That could make the stocks’ 4.6% dividend yield a good addition to your portfolio if it needs a little more energy exposure.

Merck is dealing with normal headwinds

Merck is one of the largest and most successful pharmaceutical companies in the world. The 3.4% yield is attractive relative to the broader market’s 1.2% yield; however, some dividend investors may find it a bit too low for their tastes. The stock just had a fairly impressive rally, but it is still around 25% below its 2024 highs. It might still be of interest to long-term investors, noting that the yield of the average drug stock is just under 1.1%.

The problem for Merck is that it faces the expiration of some important drug patents in the coming years. This is known as a patent cliff because, when blockbuster drugs lose their patents, revenues and earnings can take a big hit. The patent cliff is a concern, but such events are fairly common for a large drug company. Merck will eventually develop new drugs or acquire new drugs to replace those that are losing patent protection.

Today’s Change

(-1.16%) $-1.17

Current Price

$99.72

Key Data Points

Market Cap

$248B

Day’s Range

$99.19 – $102.09

52wk Range

$73.31 – $105.84

Volume

19K

Avg Vol

13M

Gross Margin

75.81%

Dividend Yield

3.25%

Meanwhile, it is worth highlighting that Merck’s dividend payout ratio is fairly reasonable at around 45%. There’s ample room for the company to support the dividend as it deals with its patent expirations. It is a solid choice in the drug sector if you are OK with a sub-4% dividend yield.

Two maybes and a wait and see

Chevron and Merck could be attractive dividend options for the right types of investors. Recognize, however, that they each require some compromises if you are going to buy them. Verizon, meanwhile, is probably best left to more aggressive investors right now. Most will probably want to wait to see what the management change brings before jumping aboard.