Here’s what lies ahead for the economy in 2026 – depending on who you ask

The latest headlines from our reporters across the US sent straight to your inbox each weekday

Your briefing on the latest headlines from across the US

Your briefing on the latest headlines from across the US

The prevailing opinion of what lies in store for the U.S. economy in 2026 is a whole lot of uncertainty, according to experts.

Across the board, financial institutions and economists held a relatively positive outlook of growth in 2026 – though they warn several factors could disrupt that.

Over the past year, President Donald Trump’s trade wars have caused the stock market to fluctuate wildly, while his mission to deport millions of undocumented immigrants has shrunk the labor market and reduced Social Security revenue.

Trump’s tariff policies have also raised U.S. household costs by an estimated $1,100 in 2025, according to the nonpartisan group The Tax Foundation.

Some finance experts appear cautiously optimistic that economic growth will be steady, albeit slow. But the looming unknown is investment in artificial intelligence.

open image in gallery

Stocks performed relatively well in 2025, though they experienced dips due to Trump’s trade wars (AFP via Getty Images)

The economic experts relied on trends in GDP, employment levels, consumer prices, inflation and other economic markers to make their estimations.

The Organization for Economic Cooperation and Development, a group made up of 38 countries including the U.S., predicts Real GDP to slow by 1.7 percent next year, citing sluggish employment growth, a slowdown in immigration, tariffs increasing prices and the government’s cuts to non-defense, discretionary spending.

The economic group warns that “fiscal policy is on an unsustainable trajectory” and that the “full impact of the tariff increases… has likely not yet been felt.”

Some financial institutions held a more positive outlook for U.S. Real GDP – the percentage change of the country’s economic output, adjusted for inflation.

The Royal Bank of Canada Wealth Management predicts 2.2 percent growth next year. S&P Global Inc. predicts Real GDP growth of 2 percent but caveats that outlook by saying that “consumer spending growth will hit a cycle low over the next two years.”

Morgan Stanley somewhat vaguely predicted “Moderate Growth With a Range of Possibilities” in 2026, but suggested the GDP could grow by 3.2 percent. While the bank expressed positivity toward AI investments, it warned that other factors, such as tariffs and immigration, could hit the economy harder than expected.

open image in gallery

With tariffs expected to increase the cost of consumer goods, economists are looking at shoppers’ spending habits to determine how hard the tariffs are hitting households (Getty Images)

Consumer spending and price trends are also key markers to determine how confident households are feeling in the economy. More spending shows that people are able to afford goods, thus stimulating the economy and job market.

Many have waited with bated breath over recent months to see how tariffs would impact consumer prices.

“The tariffs’ economic and market impact may be much more manageable than investors feared in April,” JP Morgan Wealth Management said in its 2026 outlook. “Inflation has been relatively contained, while consumer spending and corporate earnings have proved resilient.”

The Supreme Court is currently weighing whether or not to allow the president to impose sweeping tariffs on nearly every one of the U.S.’s trading partners. Whatever the court decides will likely change financial institutions’ outcomes for 2026.

open image in gallery

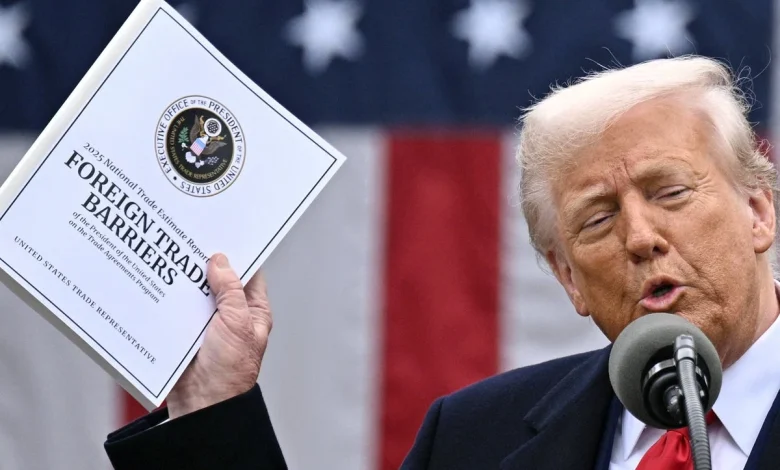

In April, President Donald Trump introduced sweeping tariffs on nearly every one of the US’s trading partners, worrying economists that consumer prices would skyrocket (AP)

For many investors, the boogeyman of 2026 is the supposed AI bubble.

There is widespread concern that financial investment in the high-tech space is due to speculative excitement, and that the technology’s practical application isn’t at a point where it can generate genuine profit.

If the bubble were to “pop” – as it did during the dot.com boom and the 2008 subprime mortgage crisis – it could trigger a negative economic reaction, tanking the stock market, nosediving companies’ profits, and causing consumers to pull back spending, and more.

Whether or not there is an AI bubble, and if it bursts, is up for debate.

JP Morgan is confident there is no AI bubble, but warned investors to rein in their excitement about the developing technology.

open image in gallery

Sam Altman, the founder and CEO of OpenAI, warned that an AI bubble was likely forming – a concern that tech investors have raised and predicted could cause economic disruption if it ‘pops’ (Getty Images)

“In our view, physical, social and political constraints on the AI expansion should act as a moderating influence, helping to restrain excess investor euphoria and giving labor markets more time to adjust to potential disruption,” JP Morgan wrote.

Bank of America analysts believe the current boom in the technology sector “is still on solid ground” and does not mimic past bubbles. “Concerns about an imminent AI bubble are overstated, in our view, and we expect AI investment to continue to grow at a solid pace in 2026,” Candace Browning, Bank of America’s head of global research, said in a statement.

But Sam Altman, who is at the forefront of the industry as CEO of OpenAI, the creator of ChatGPT, sounded a more concerning note earlier this year.

“Are we in a phase where investors as a whole are overexcited about AI? My opinion is yes,” Altman told The Verge in August.

At the same time, Altman believes AI is “the most important thing to happen in a very long time.”