Is another Dollar slide about to start?

Earlier this year, I spent a lot of time writing about the Dollar. That was in the wake of the chaotic rollout of reciprocal tariffs in early April, when consensus got very bearish on the Dollar. In fact, sentiment got so bad that some were talking about capital flight out of the US and a loss of reserve currency status. None of that happened. Currency markets are notoriously cynical. If they’re willing to put up with Erdogan in Turkey or Xi in China, there’s no way they’re going to get their knickers in a twist over Trump.

All that said, this week’s Fed has sparked a sharp fall in the Dollar, which is down around one percent since the meeting. As always, the question is whether this is the start of a bigger drop or whether it’s just noise. This post looks at recent Dollar price action and what’s going on with interest rate differentials. Things don’t look like there’s much room for further Dollar downside.

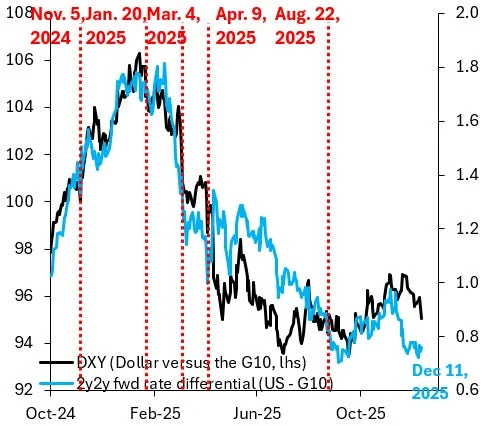

The chart above shows Bloomberg’s DXY index in black, which measures the trade-weighted strength of the Dollar against six other currencies. The blue line is the 2y2y forward rate differential of the US versus the trade-weighted foreign equivalent. The key thing to focus on is this: after the chaotic rollout of reciprocal tariffs, the Dollar fell more sharply than the 2y2y forward differential. At the time, this drew parallels with the bond market crisis in the UK in late 2022, when the Pound fell sharply even as UK yields rose. That’s not really what was going on for the US, but the Dollar – for a while – was clearly falling much faster than the 2y2y forward differential.

It’s the reverse currently. The 2y2y forward rate differential has been falling sharply, even as the Dollar has held up. What’s happening now is that currency markets are catching down to the differential, which isn’t unusual. There’s no law of nature that says the Dollar should always trade in synch with rate differentials.

Why is the Dollar relatively more resilient now? The simplest reason is that all the extreme Dollar negativity from earlier this year has worn itself out. That narrative ultimately needed to be validated by price action, which didn’t happen. As a result, markets are cautious about Dollar downside and – if anything – have a bias to be long. The bottom line is that the Dollar doesn’t have much further to fall. Markets are tired of all the Dollar blow-up stories.