Pittsburgh property taxes calculator for 2026: city, schools

Over the weekend, Pittsburgh City Council approved a 20% property tax hike for next year.

The increase isn’t totally finalized — Mayor Ed Gainey has 10 days to review it and can veto the budget. But given that council passed the hike with a veto-proof, six-vote majority, the increase is quite likely to move forward.

It was the second tax hike to hit Pittsburgh residents in a week, after Pittsburgh Public Schools approved a 2% tax increase as part of its 2026 budget.

All of which leaves city residents asking: What are my local property taxes going to be next year?

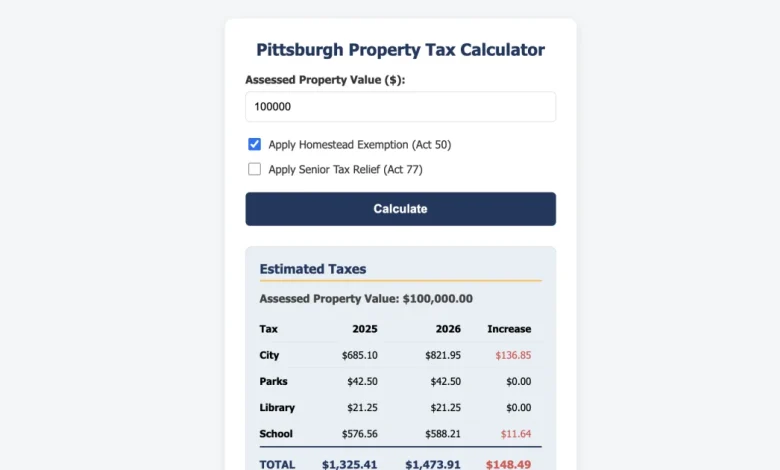

We built a simple calculator to help you get a good estimate.

A quick recap of what’s happening for property taxes:

- City Council has passed a budget to raise the rate from 0.806% to 0.967%

- The parks tax remains 0.05%

- The library tax remains 0.025%

- The schools tax is going from 1.025% to 1.0457%

On to the calculator!

Figure out your 2026 taxes

- Look up your address on the Allegheny County Real Estate website.

- On the General Information page, scroll down to the 2026 Full Base Year Market Value (Projected). Copy the “Total Value” number. This is your “Assessed Property Value.” Paste it into the blank space in our calculator.

- If you own the house you live in, check the Homestead Tax Exemption box. (More details below.)

- Check the box if you’re eligible for the Senior Tax Relief.

- Calculate!

How property taxes and millage rates work

City of Pittsburgh residents pay taxes for four city-level entities: the city itself, Pittsburgh Public Schools, the parks system, and the Carnegie Library of Pittsburgh system.

All four taxes are determined using a millage rate. Pittsburgh Public Schools’ new millage rate, for example, is 10.457. Homeowners will pay $10.457 of tax for each $1,000 of their assessed property value.

Unless you’re an accountant or work for a taxing entity, though, millage rates are remarkably confusing.

Here’s the translation: A 10.457 millage rate is the same as a 1.0457% tax.

So, a far-easier calculation for your school taxes: Take your assessed property value and multiply it by 1.0457%.

If your home, for example, had an assessed value of $100,000, you would pay $1,045.70 in property taxes to PPS in 2025.

You’d apply the city (new rate of 0.967%), parks (0.05%) and library (0.025%) rates the same way.

Note: Allegheny County leverages taxes separately; last year, the county raised property taxes by 36%.

City tax exemptions & discounts

Pittsburgh residents have two main exemptions (and an early-bird discount) to reduce their property taxes.

The first is the Homestead Tax Exemption (Act 50), for which owner-occupied buildings are eligible. In short: If you live in a home you own, you can lower your home’s total assessed value and your resulting taxes.

- The Homestead exemption for city, parks and library taxes is $15,000. So if your home has a $100,000 assessed value, you’ll pay taxes on just $85,000 of it.

- The school district, meanwhile, provided a flat $43,750 Homestead exemption in 2025.

The second exemption is Senior Tax Relief (Act 77), which reduces a home’s tax assessment by 40% for lower-income seniors.

Finally, if you pay your property taxes by Feb. 10, you can get a further 2% discount. (If you’re comparing your tax receipt from last year with the calculator’s figures and finding a small discrepancy, that might explain it.)