Mexico’s Growth Stagnation – Robin J Brooks

Mexico is a puzzle. In the five years before the pandemic, growth ground to a halt. At the time, this made the country a total outlier from the rest of emerging markets (EM) and it’s especially puzzling given that Mexico borders the US and should be reaping the benefits of globalization more than any other EM. In the immediate aftermath of COVID, it looked like Mexico might escape its growth stagnation. But unfortunately the country has fallen back into the same stagnation it was in before the pandemic.

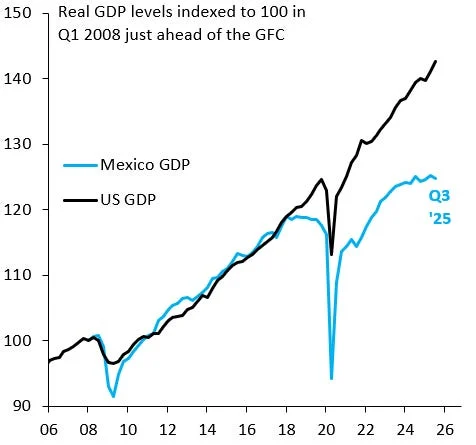

The chart above shows just how jarring Mexico’s growth stagnation is. It shows real GDP in the US (black line) and Mexico (blue line), where I’ve indexed both series to be 100 just before the global financial crisis in 2008. Starting from 2017, growth ground to a halt and real GDP flat-lined. The immediate aftermath of the pandemic gave the impression Mexico might escape this growth trap, but we’re basically back to the same stagnation picture in recent years that prevailed pre-COVID.

Mexico’s renewed stagnation is especially notable because there was a massive investment boom after the pandemic as the chart above shows. This boom got going in 2022 and ended in early 2024, just ahead of the election that got Claudia Sheinbaum elected as President. The hope was that this investment boom would spill over into other sectors of the economy, but that clearly hasn’t happened. In my opinion, this makes the renewed stagnation now all the more worrying.

The chart above shows what’s going on in terms of the different components of GDP. You can clearly see the investment boom (red bars), which lifted growth in the years between 2022 – 2024. But that investment boom has faded – it was never sustainable – and has turned into a drag on growth. The key reason why growth has fallen back to near zero is private consumption (blue bars), which is back to being as weak as it was in the five year period before the pandemic.

Mexico didn’t provide the kind of fiscal support to households that many other countries did during the pandemic. That’s why the contraction in GDP was so much more severe than elsewhere and explains why growth bounced back more strongly in the years immediately after COVID. The basic equilibrium – whereby what should be a vibrant EM is stagnating with no end in sight – is the same as before the pandemic.

The reasons for Mexico’s stagnation are complex, but what’s clear is that the lack of growth should at this point be regarded as a structural problem. For some reason, the gains from globalization – Mexico’s exports to the US are doing extremely well – are not benefitting the broader population, which is why private consumption stagnates. This is is the basic problem. The gains from trade aren’t benefitting enough people.