Mexico’s Growth Trap – Robin J Brooks

Earlier this week, I wrote a post about the lack of growth in Mexico. In the five years leading up to the pandemic, Mexico’s GDP growth ground to a halt, even as growth in the US was strong. In the immediate aftermath of COVID, it looked like Mexico had escaped that growth trap, but this was an illusion. At the time, a big investment surge linked to Tren Maya made growth look stronger than it really was. Now that this investment surge is over, Mexico has fallen back into the same growth trap it was in before the pandemic. Mexico’s lack of growth is a structural problem.

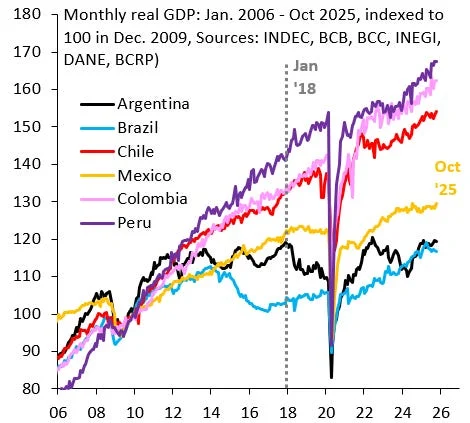

As I noted in a follow-up post, most of Latin America is struggling to grow. The chart above shows monthly GDP levels across key countries. Key economies like Argentina (black line) and Brazil (blue line) are stuck at real GDP levels that have been constant for over a decade. But Mexico (orange line) is unique in that there’s really not sign of a growth pick-up even recently. Brazil has at least been digging itself out of the hole that opened up after 2014. There’s no sign of anything like this for Mexico.

The key question is what – if anything – can be done to propel Mexico out of its growth stagnation. On paper, the country has so many advantages over its peers in Latin America: it borders the US, is part of USMCA and its exports to the US are stronger than ever. The big public investment push could have also catalyzed more lasting growth, but that didn’t happen. My sense is that the benefits from Mexico’s advantages – its integration into global supply chains and proximity to the US – aren’t shared widely enough within the country. That’s the best rationale for why private consumption growth is so anemic, which is the main reason for Mexico’s stagnant GDP. This is a structural issue and reflects an elite that doesn’t share Mexico’s gains sufficiently with the broader population, no matter who’s in power. But it’s worth making a side note on the currency. As the chart above shows, the Mexican Peso (red line) is also much stronger than peers like the Colombian Peso (blue line) or Brazilian Real (black line). Mexico is compounding its structural problems with a currency that’s way too strong and preventing foreign manufacturers from shifting more value-added production to the country. The solution is deep structural reform to spread the gains from globalization more evenly, coupled with much looser monetary policy.