What Is One of the Best Quantum Computing Stocks to Own for the Next 10 Years?

IBM is leading the way.

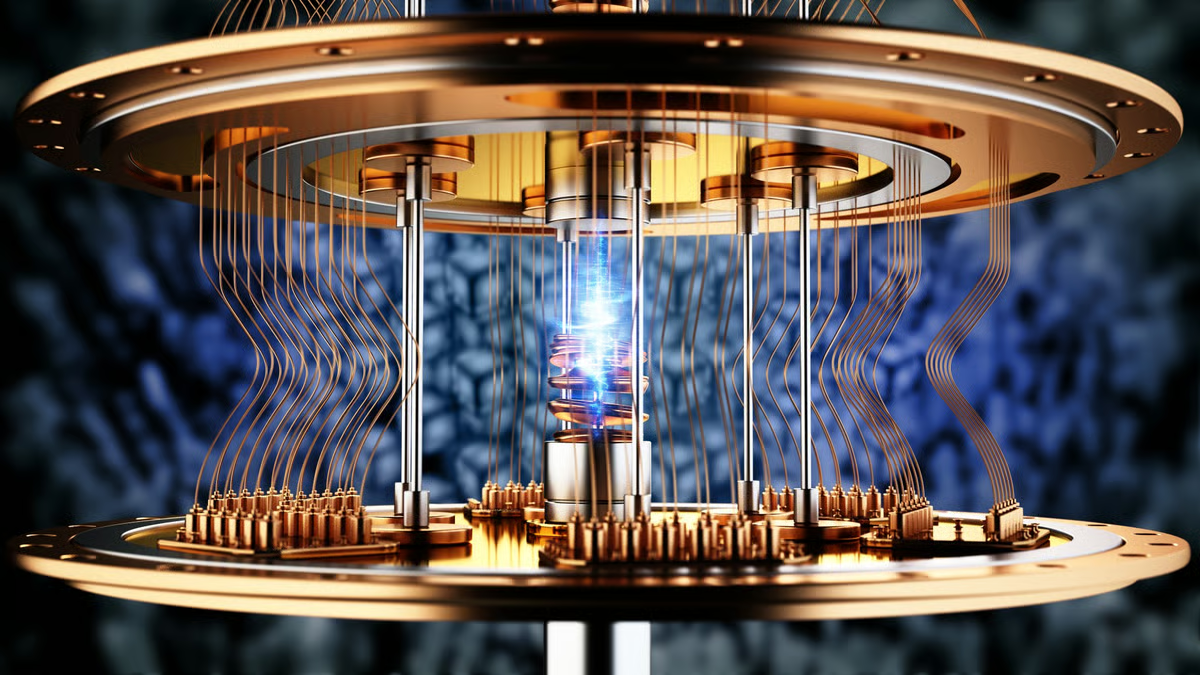

Quantum computing, which leverages the probabilistic nature of quantum physics to accelerate certain types of computations exponentially, may be the next major technological revolution. While quantum computers aren’t commercially useful today, a multitude of companies are aggressively pursuing that goal.

Image source: Getty Images.

Over the next decade, it’s possible that quantum computers will be successfully applied to real-world applications as researchers continue to address outstanding challenges, such as error correction. Materials science, logistics, drug discovery, finance, cybersecurity, and artificial intelligence are some areas where quantum computing can potentially have a significant impact. While there could be multiple winners, International Business Machines (IBM 1.07%) is the best quantum computing stock to own.

The march toward useful quantum computers

Earlier this year, IBM disclosed that it was nearing $1 billion in cumulative signings related to quantum computing. The tech giant works with hundreds of partners, including established companies, start-ups, and academic institutions, as it drives toward commercially viable quantum computing.

In 2026, IBM plans to demonstrate a clear example of quantum advantage, where a quantum computer paired with traditional computing techniques accelerates real-world scientific computations. The company then expects to develop the first fault-tolerant quantum computer by 2029. At that point, the name of the game will be scaling up a useful number of quantum bits, which IBM anticipates will occur in 2033 and beyond.

In November, IBM announced its new Nighthawk quantum processor, which pairs 120 qubits with 218 tunable couplers. Nighthawk will be iterated over the next few years and will play a starring role in the company’s plan to demonstrate quantum advantage.

International Business Machines

Today’s Change

(-1.07%) $-3.16

Current Price

$293.05

Key Data Points

Market Cap

$277B

Day’s Range

$292.52 – $297.57

52wk Range

$214.50 – $324.90

Volume

614K

Avg Vol

4.8M

Gross Margin

57.22%

Dividend Yield

2.27%

Pure-play quantum computing companies will need to continually raise funding to sustain operations over the next decade. IBM doesn’t have that problem. With a clear roadmap and a long track record of quantum innovations, IBM is an easy choice.

Timothy Green has positions in International Business Machines. The Motley Fool has positions in and recommends International Business Machines. The Motley Fool has a disclosure policy.