More Bonds Are Teetering on the Brink of Junk: Credit Weekly

JPMorgan Chase & Co.

(Bloomberg) — Beneath the calm surface of the US corporate bond market, there are worrying signs about companies that could lose their investment-grade status.

The first full week of the year has been one of the busiest for US corporate debt sales on record, and risk premiums stayed low even amid heavy issuance. But the amount of bonds teetering on the brink of junk surged last year, according to JPMorgan Chase & Co.

Most Read from Bloomberg

Around $63 billion of US corporate bonds in the high-grade universe have a high-yield rating from one bond grader, a BBB- rating from others, and at least one negative outlook, according to the bank’s review based on ratings for debt in its high-grade US index. That figure was $37 billion at the end of 2024, JPMorgan strategists wrote.

“As companies continue to refinance debt, the pressure on their balance sheets from rising interest expense is growing,” said Nathaniel Rosenbaum, a US high-grade credit strategist at JPMorgan. “That, in turn, does put a little bit more ratings pressure on weaker credits.”

JPMorgan doesn’t anticipate market turmoil anytime soon. Demand from investors is still strong, and earnings will probably be relatively strong in the coming weeks, leaving spreads relatively rangebound.

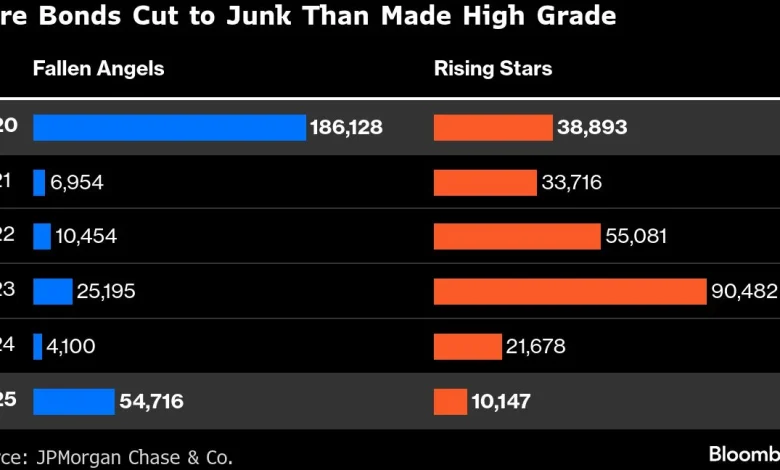

But there are still risks in credit. About $55 billion of US corporate bonds migrated from investment-grade to junk status in 2025, becoming “fallen angels,” according to JPMorgan. That far exceeds last year’s $10 billion of “rising stars,” or firms elevated to high-grade. And the trend is set to continue, the strategists say.

BBB- debt is just 7.7% of JPMorgan’s US high-grade corporate index, a record low share. But a relatively high amount of debt is susceptible to being cut to junk. Companies typically see their spreads blow out when they lose their high-grade status, as the universe of junk bond investors is much smaller in dollar terms than investment-grade.

There are reasons to be a little more concerned about credit risk now: Broad measures of indebtedness have been creeping higher relative to earnings, fueled by rising yields after the pandemic, a flood of spending on artificial intelligence, and acquisitions.

“If you look underneath the hood there are underlying signs of weakening in credit profiles,” said Zachary Griffiths, head of US investment grade and macro strategy at CreditSights Inc.

But in the near term, demand for bonds has been strong. And fiscal stimulus from some provisions of the One Big Beautiful Bill Act could help keep consumer sentiment “a little more buoyant,” Griffiths said.

Generally, money manager have been less worried about credit risk for months. Investment-grade spreads have spent much of this week averaging 0.78 percentage point, or 78 basis points, and haven’t risen above 85 basis points since June, according to Bloomberg index data. The mean for the last decade is closer to 116 basis points.

For 2026, JPMorgan expects a slowdown in credit ratings upgrades, and cites acquisitions and re-leveraging from AI issuers as key drivers. The highest quality tech issuers could add leverage and accept ratings that are a notch lower, points out Rosenbaum, as there isn’t much spread penalty within investment-grade when going from low AA to high A, for instance. Changing their capital structure could help make them more competitive in the AI financing deluge, he said.

Still, some investors are looking to cut their exposure to companies that are piling on risk.

“We are avoiding issuers that may be stressing their balance sheets to fund significant capex plans or engage in M&A,” said David Delvecchio, managing director and co-head of the US investment grade corporate bond team at PGIM Fixed Income, which oversees $906 billion as of September.

Click here for a podcast on ‘the Everything Bubble’ with Richard Bernstein Advisors

Week In Review

-

Global bond sales had their busiest ever start to a year as borrowers of every stripe seize on investors’ insatiable appetite for risk. Issuers are looking to sell debt ahead of earnings blackouts and a potential surge of sales tied to artificial intelligence projects.

-

US President Donald Trump is directing Fannie Mae and Freddie Mac to purchase $200 billion in mortgage bonds, a move he cast as his latest effort to bring down housing costs ahead of the November midterm election.

-

Saks Global Enterprises is looking to line up a loan of as much as $1 billion to keep the business running as part of a Chapter 11 bankruptcy filing that could come as soon as Sunday.

-

China Vanke Co. is preparing a debt restructuring plan at the request of authorities, people familiar with the matter said, pushing one of the country’s largest real estate developers closer to default.

-

First Brands Group Inc. warned it will run out of cash by the end of January without an immediate financing injection, a shortfall that could force the bankrupt auto-parts maker to shut down some businesses and sell other operations.

-

First Brands founder Patrick James said Jefferies Financial Group was refusing to turn over documents that would “put the lie” to the financial firm’s claims that he defrauded it.

-

A major financier to First Brands is accused of orchestrating a kickback scheme with the founder’s brother that loaded the auto-parts supplier with expensive debt.

-

-

Warner Bros. Discovery Inc. rejected an amended takeover offer from Paramount Skydance Corp. and encouraged shareholders to stick with a deal it has in place with Netflix Inc., voicing skepticism about the interloper’s ability to pull off what it said would effectively be the largest leveraged buyout in history.

-

A $7 billion loan backing Blackstone Inc. and TPG Inc.’s acquisition of Hologic Inc. was officially offered to investors with a leverage level of seven times.

-

Separately, $1.2 billion of leveraged loans were launched to help finance the buyout of a Finastra Group Holdings Ltd. unit. And a $1.8 billion leveraged-loan deal kicked off to help fund the buyout of Hillenbrand Inc.

-

-

Charter Communications Inc. sold $3 billion of junk bonds as it looks to pay off debt due through 2027 and repurchase equity. Meanwhile, Six Flags Entertainment Corp. sold a $1 billion junk bond in the market’s riskiest tier, as strong demand allowed the deal to price at a yield well below initial price talk.

-

Royal Bank of Canada and Deutsche Bank AG are pre-marketing about $1.8 billion of debt tied to Investindustrial’s takeover of TreeHouse Foods Inc.

On the Move

-

Wells Fargo & Co. hired Danny McCarthy to oversee the credit franchise in its capital-markets business, bringing in an industry veteran to lead a key part of the largest revenue driver on its trading desk.

-

Yulia Alekseeva has been named head of fixed income at MissionSquare, an asset manager that invests money on behalf of public sector workers. She was most recently head of consumer asset-based finance at Barings.

-

Bond market veteran Jean-Luc Lamarque has left Credit Agricole SA after a career at the bank spanning almost 30 years.

-

Ares Management Corp. has hired former CapitaLand Investment executive Gabriel Fong as partner for Asia credit, focusing on special situations.

–With assistance from Emily Graffeo.

Most Read from Bloomberg Businessweek

©2026 Bloomberg L.P.