Gen Z sees jobs as short-term ‘situationships,’ new survey reveals

Stay ahead of the curve with our weekly guide to the latest trends, fashion, relationships and more

Stay ahead of the curve with our weekly guide to the latest trends, fashion, relationships and more

Stay ahead of the curve with our weekly guide to the latest trends, fashion, relationships and more

Generation Z isn’t making a long-term commitment to their jobs, according to a new survey.

The demographic cohort born roughly between 1997 and 2012, following Millennials and preceding Gen Alpha, is characterized as the first true “digital natives.”

Researchers at Gateway Commercial Finance spoke to more than 1,008 employees, half of whom were Gen Z and half of whom were managers or employees with hiring experience. Results found that 58 percent of interviewees viewed their jobs as “situationships” — a short-term, low-commitment relationship that isn’t meant to last.

47 percent of respondents said they planned to leave their job within a year of starting it, and nearly half of those surveyed were ready to quit at any time.

The survey also revealed how Gen Z views their jobs: only 46 percent believe there are benefits to staying with a single employer in today’s job market. Meanwhile, 37 percent see their current role as nothing more than a paycheck, and just 25 percent consider it a long-term opportunity they’re truly invested in.

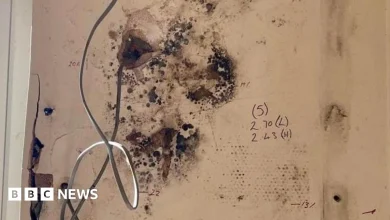

Gen Z professionals don’t want to stay at their job long-term, according to a new survey (Getty Images)

When asked why they might leave their positions, 55 percent cited higher salaries elsewhere. At their current jobs, 34 percent of Gen Z professionals report poor mental health and burnout, and 22 percent feel undervalued or unrecognized.

Hiring managers, however, aren’t impressed by this lack of loyalty. One in four sees short-term roles — lasting less than a year — on a Gen Z resume as a red flag, and more than one in three admit they’ve decided not to hire a Gen Z candidate because of job-hopping.

Previous studies have explored Gen Z’s career priorities, including a strong focus on financial well-being. According to Bank of America’s 2025 Better Money Habits financial education study, 72 percent of Gen Z took steps to improve their financial health over the past year. Yet only 39 percent reported receiving financial support from their families — a decline from 46 percent in 2024.

Holly O’Neill, president of consumer, retail, and preferred banking at Bank of America, said in a statement that Gen Z is “challenging the stereotype when it comes to young people and their finances.”

“Even though they’re facing economic barriers and high everyday costs, they are working hard to become financially independent and take control of their money,” O’Neill said.