TSMC surges after posting stellar Q4 results, impressive Q1 outlook

TSMC is ripping higher in premarket trading after the world’s largest chip manufacturer posted superb Q4 results and offered a Q1 outlook that was brighter than analysts had anticipated.

The Taiwanese firm posted Q4 earnings per share of NT$19.50 (or $0.63), well above estimates for NT$18.12 (or $0.57).

The company’s ability to turn sales into profits was also better than analysts had projected, with a Q4 gross margin of 62.3% (estimate: 60.6%) and operating margin of 54% (estimate: 50.9%). Both figures exceeded the upper end of management’s Q4 guidance.

The foundry giant had already provided sales figures through December as of last Friday, which totaled NT$1.046 trillion (or approximately $33.7 billion). That figure was ahead of Wall Street’s projection for NT$1.02 trillion.

For the current quarter, management expects revenues to come in between $34.6 billion and $35.8 billion, far exceeding the consensus estimate for $33.2 billion.

Its outlook for margins was similarly robust, with gross margins expected to range from 63% to 65% (estimate: 59.6%). Its operating margin guidance was 54% to 56%, the low point of which is still above the highest analyst’s estimate.

These strong results also fueled gains for ASML, the Dutch maker of lithography machines key to the manufacturing of chips.

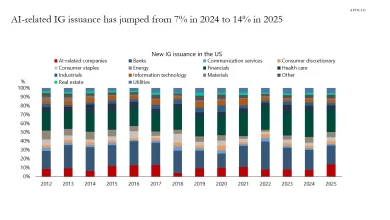

The AI boom is in full swing, and everyone’s looking for TSMC to serve as a key partner to meet demand for their products. On their earnings call, management indicated that its capital budget would be between $52 billion and $56 billion this year, with 70% to 80% of that being allocated to advanced process technologies.

This release was preceded by reports that Taiwan expects to sign a trade deal with the US imminently, in which TSMC is expected to play a key part. Taiwanese officials are aiming to get tariffs lowered as well as earn special treatment for semiconductor exports, as the company expands its manufacturing footprint on US soil in return.

The positive reaction this morning looks to be bucking a trend for TSMC’s stock, which has fallen in 12 of the last 13 sessions after reporting quarterly results.