US to invest $1.6bn into rare earths group in bid to shore up key minerals

Unlock the White House Watch newsletter for free

Your guide to what Trump’s second term means for Washington, business and the world

The Trump administration is planning to inject $1.6bn into an American rare earths company, its biggest investment in the sector, in Washington’s latest foray into private industry to shore up supplies of key minerals.

The US government will receive a 10 per cent stake in USA Rare Earth, a publicly traded Oklahoma-based miner that controls significant US deposits of heavy rare earths, according to people familiar with the matter.

The government investment and a separate $1bn private financing deal are expected to be announced on Monday, according to people familiar with the situation.

One person said the government would get 16.1m shares in USA Rare Earth and warrants for another 17.6m, both at a price of $17.17. The government agreed to pay $277mn for the equity, giving it an implied gain of $490mn for the equity and warrants based on the current share price of $24.77.

USA Rare Earth will also receive $1.3bn in senior secured debt financing at market rates from the government. The money will come from a finance facility created for the commerce department as part of the CHIPS and Science Act passed in 2022. A commerce official said the department completed the transaction directly with the company.

Talks progressed rapidly this week as investor interest returned to critical mineral stocks after President Donald Trump said Washington had reached the “framework” for a deal that could include access to Greenland’s untapped critical mineral wealth. One person familiar with the situation noted that the USA Rare Earth deal was unrelated to Greenland.

USA Rare Earth declined to comment. The commerce department declined to discuss the deal. But an official in the Chips office — a part of the commerce department housed at the National Institute of Standards and Technology that led the negotiations — said it was “focused on onshoring critical and strategic mineral essential to the semiconductor supply chain and US national security”.

USA Rare Earth has separately tapped Cantor Fitzgerald, the Wall Street firm previously owned by commerce secretary Howard Lutnick and now run by his sons, to raise more than $1bn in fresh equity financing, the people said. It is not directly related to the deal with the government.

The deal marks the latest example of the Trump administration’s efforts to intervene in parts of the private sector viewed as critical to US national security, including taking a 10 per cent stake in chipmaker Intel and negotiating a so-called golden-share agreement in US Steel.

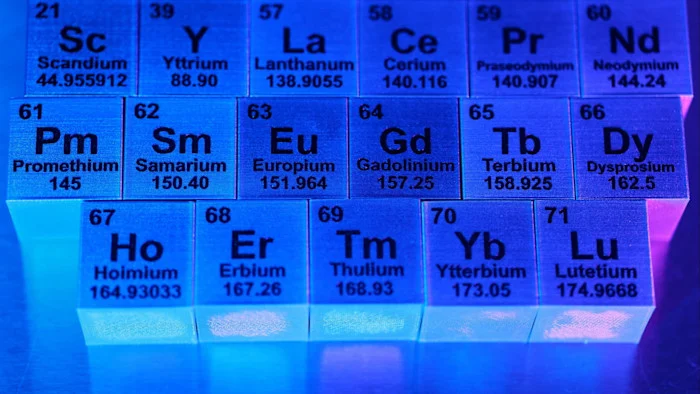

USA Rare Earth, which has a market value of $3.7bn, is developing a huge mine in Sierra Blanca, Texas that it says contains 15 of the 17 rare earth elements underpinning production of cell phones, missiles and fighter jets. It also plans to open a magnet production facility in Stillwater, Oklahoma.

Last year, the Trump administration invested in at least six minerals companies, including MP Materials, Trilogy Metals and Lithium Americas.

Some of the investments overlapped with the financial interests of people associated with the administration. The government did a funding deal with Vulcan Elements, a rare earths start-up three months after the president’s son Donald Trump Jr’s venture capital group invested in the company.

The commerce department and defence department have worked closely together to financially boost domestic rare earth production.

A condition of the government investment in USA Rare Earth was that the company raise at least an additional $500mn from investors. It is on track to raise more than $1bn because of high demand for the financing deal, which uses a mechanism known as a private investment into a public equity, often called a “Pipe”.

Cantor’s involvement comes as the investment bank once led by Lutnick, one of Trump’s most prominent cabinet members, has expanded its investment banking capabilities to benefit from the president’s “America first” agenda. Cantor did not play a role in advising on the US government investment in USA Rare Earth.

Shares in USA Rare Earth have more than doubled this year, helped by a 40 per cent jump this week. The company also sought advice from Cantor when it went public via a blank cheque vehicle in March last year.