Why the Dollar is falling

The Dollar is falling swiftly, in line with my call that 2026 will see a resumption of Dollar weakness after the hiatus in the second half of last year. What’s fascinating is what markets react to and what they ignore. They ignored various assaults on the Fed, including efforts to remove Lisa Cook and the threat of criminal indictment of Chair Powell. That’s remarkable, but – as people say in markets – it is what it is. But markets drew the line last week on Greenland. The Dollar fell very sharply in a move that looks like it’s still building. There’s a lot of similarities between what’s happening now and the sharp fall in the Dollar in April 2025 after the rollout of reciprocal tariffs. This post looks at what’s going on and highlights three things.

-

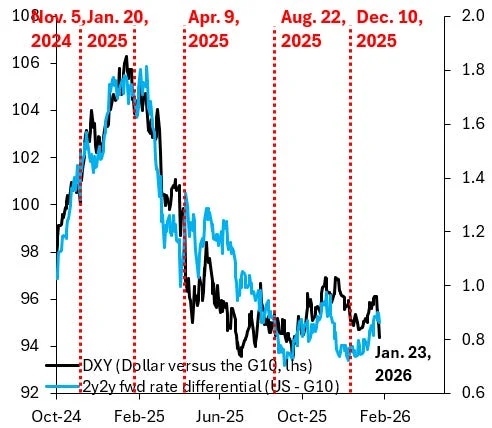

A perception of policy chaos: back in April 2025, the rollout of reciprocal tariffs plus the extreme escalation of the tariff stand-off with China caused markets to sell the Dollar very abruptly, as the black line in the chart below shows. What’s interesting about that drop is that it was accompanied by a sharp fall in interest rate differentials, which is what the blue line shows. The verdict from markets was basically that all those tariffs would backfire on the US, both because the US was picking fights with practically everyone and because of their chaotic rollout. What’s happening now is very similar. Last week’s sharp fall in the Dollar is again accompanied by a drop in the 2y2y forward rate differential. Markets think the fight over Greenland and the chaotic manner in which this was handled will backfire on the US and require lower US interest rates vis-à-vis the G10.

-

Markets got complacent: in the end, the biggest determinant of sentiment is price action. The fact that the Dollar stabilized in the second half of 2025 – in the face of many alarmist narratives that foretold a huge sell-off – made people give up on Dollar downside. That’s apparent in the CFTC’s weekly CoT report, where the black line in the chart below shows the overall Dollar position against the world’s major currencies. As of January 20, this position was essentially flat, meaning that this subset of the FX market didn’t think the Dollar would do much of anything. Markets de facto gave up on the Dollar downside story, which is why I think the odds are now high that we’ll see a sustained and substantial fall.

-

Bullish on US growth, but not on the Dollar: foreign flows into US assets are incredibly strong as the chart below shows, which raises the question how the Dollar can have a sustained fall if so many people are buying US assets. The answer is that you need to make a distinction between stocks and flows. These inflows are a pittance compared to the stock of US assets held by foreigners. If there’s a crisis of confidence in US policy making – which is what’s happening – there’s a lot of hedging that needs to happen. Foreigners may not sell their US holdings outright, but they’ll sell the Dollar forward in currency markets to protect themselves against future Dollar declines. This is what happened last week and what also happened in April 2025. There’s therefore really no contradiction between continued strong inflows and Dollar weakness.

I’m just as puzzled as most people that markets ignored the various assaults on the Fed. Those to me are alarming and should have seen the Dollar fall. But it’s clear that markets draw the line when the Trump administration upsets its allies. That was a big part of the Dollar fall in April 2025 and my best guess is that this is what’s playing out again now.