What’s Going On with the Dollar?

I am always searching for interesting and informative charts, especially ones I can include in my quarterly call, that explain something clients are curious about or highlight an overlooked idea. The call that started 2026 focused on the weakness in the dollar. Considering how significant the US dollar weakness has been, let’s take a look at what has been happening with the world’s reserve currency and why it matters to stocks, bonds, and commodities.

2025 was the year international stocks finally caught up to the US. Since the financial crisis, the US has led the world’s economy and equity markets. That changed significantly last year, as the S&P 500 and even the Nasdaq 100 lagged behind while international stocks gained over 33%. That was about twice the increase we saw in the U.S

And there’s a simple reason for this: The weakest U.S. dollar since 2017.

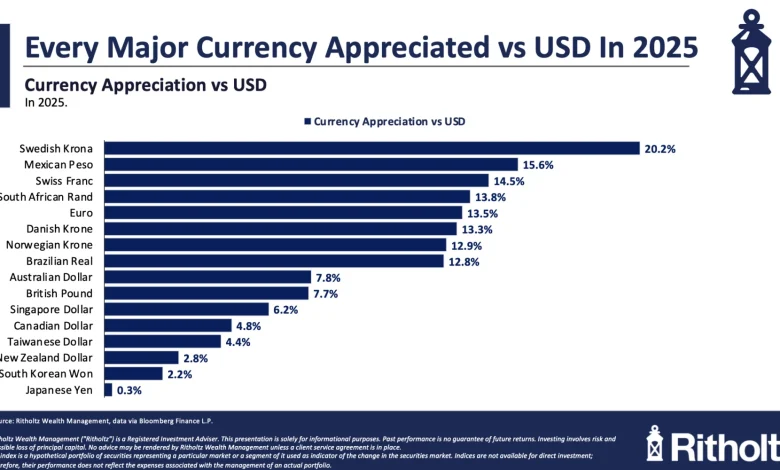

As the chart at the top of the page shows, every major currency has outperformed the United States currency in 2025 – even Japan.

That is not a coincidence. This isn’t partisan; it isn’t politics; it is simply a fact: the dollar was down 9.2%. The last time it was down this much was in 2017, when it fell 9.9%. Both years marked the first of a Trump presidency; both involved tariffs; both alienated trade partners.

Here’s a straightforward explanation:

U.S. trading partners are very unhappy with tariffs and defense policies. We are part of a deeply interconnected global economy, and although none of our trading partners has our level of wealth, they are not without options. They don’t support the end of the post-war alliances nor “America First” – and are responding accordingly.1

Thus, the trend we observed throughout 2025 was simply a Repatriation Trade. Overseas Investors, including private holdings, sovereign wealth funds, public funds, and other large pools of capital, decided to reduce some US-specific risk. They sold portions of their US holdings of stocks, and bonds. Priced in dollars, these were then converted into their local currencies—euros, pounds, yen, Swiss francs, pesos, yuan—and brought back home, where they were used to purchase local stocks and bonds.

I cannot imagine any other reason for every single major currency to appreciate so much against the US Dollar without some variation of the above occurring.

Traditionally, rates and the dollar move in lockstep; when they decouple, it usually indicates something unusual is underway. The global sale of some US holdings is the most likely explanation:

This is what happens when your trading and security partners are so unhappy with your policies that they vote with their capital. If anybody has a better explanation as to what’s going on, I’d love to hear it.

I am not a catastrophist; I don’t think this is the end of the dollar as the global reserve currency or the end of Pax Americana; it is, however, concerning and warrants attention. If you treat your trading partners poorly, they aren’t just gonna take it; they are going to respond in kind. They bought a chunk of their capital home. As it turns out, repatriating those dollars made those markets outperform US markets. Not that plus ~18% is terrible, it’s just relatively, we were the laggard.

What will cause this situation to change? I don’t see this administration reversing course unless the Supreme Court forces them to do so. I am genuinely surprised they have not done so already in what is an obvious case.

But that’s how I see the dollar story.

Previously:

IEEPA Tariffs Update (January 27, 2026)

Stocks, Bubbles & Market Myths (January 16, 2026)

Tariffs Likely To Be Overturned (November 5, 2025)

The Probability Machine (August 28, 2025)

Might Tariffs Get “Overturned”? (July 31, 2025)

MiB: Special Edition: Neal Katyal on Challenging Trump’s Global Tariffs (September 3, 2025)

See also:

A mysterious delay in the Supreme Court tariffs case

Jason Willick

Washington Post, February 1 2026

How Trump Is Debasing the Dollar and Eroding U.S. Economic Dominance

By John Cassidy

New Yorker, February 2, 2026

Trump’s chaotic governing style is hurting the value of the U.S. dollar

By David J. Lynch

Washington Post, February 2 2026

__________

1. Position Disclosures: In my personal account, my “2026 SCOTUS reverses IEEPA tariffs” trade is to be long GM, Ford, Caterpillar, and Walmart; the short Silver is a reflection that perhaps the dollar trade has gone as far as it might go for this leg…

See this chart from Jim Reid of Deutsche Bank, who noted: “It was a historic and extraordinary month for precious metals, even with the late pullback. In fact, gold (+13.3%) saw its best monthly performance since September 1999, and silver (+18.9%) posted a 9th consecutive monthly gain.”