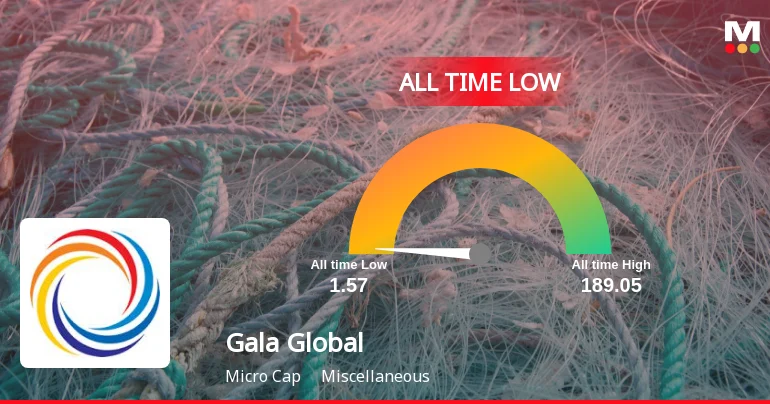

Gala Global Products Ltd Stock Hits All-Time Low Amid Prolonged Downtrend

Stock Performance and Market Context

On 6 February 2026, Gala Global Products Ltd’s share price declined by 2.53%, underperforming the Sensex which fell by 0.39% on the same day. Over the past week, the stock has dropped 7.23%, contrasting with the Sensex’s modest gain of 0.87%. The one-month performance reveals a sharper decline of 21.43%, while the three-month figure shows a 40.08% fall, significantly worse than the Sensex’s near-flat performance of -0.39% over the same period.

Year-to-date, the stock has lost 23.00%, compared to the broader market’s decline of 2.62%. Over the last year, Gala Global’s share price has plummeted by 58.49%, starkly contrasting with the Sensex’s 6.31% gain. The long-term trend is even more pronounced, with the stock down 82.66% over three years and 95.14% over five years, while the Sensex has risen 37.15% and 63.58% respectively. Over a decade, Gala Global’s share price has declined by 93.39%, against the Sensex’s remarkable 237.11% increase.

The stock currently trades below all key moving averages, including the 5-day, 20-day, 50-day, 100-day, and 200-day averages, indicating persistent downward momentum.

Financial Health and Profitability Metrics

Gala Global Products Ltd’s financial indicators reveal ongoing difficulties. The company has reported operating losses, contributing to a weak long-term fundamental strength assessment. Its ability to service debt remains limited, with a high Debt to EBITDA ratio of 13.56 times, signalling elevated leverage and financial strain.

Profitability metrics further illustrate the challenges faced. The average Return on Equity (ROE) stands at a modest 1.90%, indicating low profitability generated per unit of shareholders’ funds. The company has declared negative results for three consecutive quarters, with Profit Before Tax excluding other income (PBT LESS OI) for the latest quarter at a loss of ₹0.26 crore, representing a decline of 111.26%.

Net sales for the latest six months have contracted by 35.82% to ₹9.80 crore, while the Profit After Tax (PAT) for the same period is negative ₹2.33 crore, also down by 35.82%. These figures highlight a contraction in revenue alongside sustained losses.

Valuation and Risk Considerations

The stock is considered risky relative to its historical valuations. Over the past year, while the share price has declined by 58.49%, the company’s profits have deteriorated by an alarming 985%. This disparity underscores the severity of the financial downturn.

Consistent underperformance against benchmark indices has been a hallmark of Gala Global’s recent history. The stock has underperformed the BSE500 index in each of the last three annual periods, reflecting persistent challenges in regaining investor confidence and market traction.

Majority shareholding remains with non-institutional investors, which may influence liquidity and trading dynamics.

Summary of Market Grade and Ratings

As of 7 April 2025, Gala Global Products Ltd’s Mojo Grade was downgraded from Sell to Strong Sell, reflecting deteriorating fundamentals and market sentiment. The company’s Mojo Score stands at 3.0, consistent with the Strong Sell rating. Its Market Cap Grade is 4, indicating a relatively small market capitalisation within its sector.

The stock’s recent day change of -2.53% further emphasises the ongoing downward pressure. Despite outperforming its sector by 2.05% on the day of the latest close, the broader trend remains negative.

Trading near its 52-week low, the stock’s performance metrics and financial indicators collectively portray a company facing significant headwinds within the miscellaneous industry sector.

Conclusion

Gala Global Products Ltd’s share price decline to an all-time low encapsulates a prolonged period of financial contraction and market underperformance. The company’s weak profitability, high leverage, and shrinking sales have contributed to its current valuation and rating status. While the stock remains under pressure, the detailed financial and market data provide a comprehensive view of its present condition within the broader market context.

Upgrade at special rates, valid only for the next few days. Claim Your Special Rate →