James Cameron slams Warner Bros.-Netflix bid, favours Paramount. Here’s a breakdown of both deals

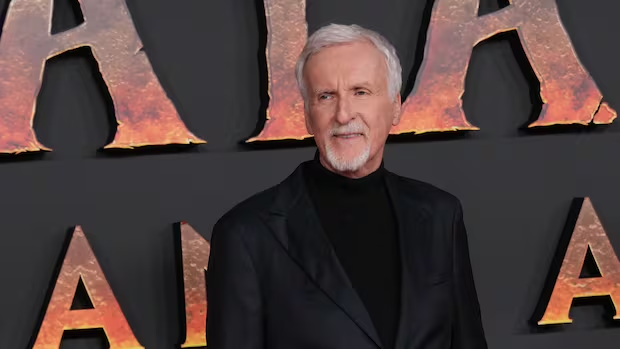

James Cameron is weighing in on the battle for Warner Bros. Discovery, calling on the U.S. Senate Antitrust Subcommittee to block Netflix’s acquisition of the Hollywood studio.

In a letter to subcommittee chair and Rublican Sen. Mike Lee that was obtained by CNBC, the Titanic director called the deal potentially “disastrous” and said it could mean “the theatrical experience of movies could become a sinking ship.”

Warner Bros. Discovery announced Tuesday it will re-open talks with Paramount Skydance under a seven-day waiver from Netflix to discuss this competing offer, though the Hollywood studio continues to back the deal it had struck with Netflix.

So the clock is ticking, but for those who may not be following the corporate back-and-forth closely, here’s a look at what each deal could mean.

What they want to buy

Netflix wants to buy the streaming and movie studio assets. That means HBO, HBO Max, Warner Bros. Film and TV Studios and DC Studios.

Paramount, which launched a hostile takeover bid for Warner Bros. late last year that was initially rejected, wants everything — the studios, the streaming assets and all of its cable networks, including CNN.

Both bids would reshape the media landscape, but in different ways — and both have raised concerns around competition.

Netflix’s proposal would merge Warner Bros.’ television and motion picture divisions, including HBO Max and DC Studios, within Netflix’s library and production arm, giving it control over a massive share of TV and film content.

Warner Bros. Discovery announced Tuesday it will re-open talks with Paramount Skydance under a seven-day waiver from Netflix to discuss the competing offer. (Jae C. Hong/The Associated Press)

Meanwhile, Paramount’s bid is partially backed by Larry Ellison, father of Paramount CEO David Ellison and one of the world’s richest people. The elder Ellison has ties to the White House as a donor and close ally of Donald Trump and his administration.

If Paramount wins, the Ellisons would control not only CBS News, but also CNN, raising concerns about media consolidation. More on that later.

What it means for moviegoers

If you prefer the experience of seeing a movie in a theatre with a bag of popcorn and a soda in hand, here’s what we know.

Netflix has released films in theatres before, but often for shorter exclusive windows before they move to streaming. However, as recently as April last year, the company’s co-CEO Ted Sarandos called the industry’s theatre model an “outdated concept.”

But when Netflix announced its deal in December, he said the streamer was “fully committed” to releasing Warner Bros. films both in theatres and at home.

WATCH | Does Netflix’s bid to buy a Hollywood studio mean curtains for movie theatres?:

Could Netflix’s Warner Bros. Discovery deal kill movie theatres?

Netflix has agreed to buy Warner Bros. Discovery’s TV and film studios and streaming division for $72 billion US. If the deal gets regulatory approval, it would shift the media landscape, and some movie theatre companies are voicing concern for their future.

Netflix has pledged to maintain the studio’s theatrical distribution arm, and in January, Sarandos said the company is committed to maintaining a 45-day theatrical release window for Warner Bros. Discovery films.

Meanwhile, Paramount has promised to release more than 30 films in theatres and to “honour traditional windows.”

Paramount Pictures is considered one of the “big five” studios alongside Universal Pictures, Warner Bros., Walt Disney Studios and Sony Pictures, all of which rely heavily on box-office revenue.

A merger with Paramount Skydance could, in theory, incentivize keeping long theatrical windows to boost ticket sales before movies move to streaming platforms.

WATCH | Regina theatres fill seats despite streaming popularity:

Sask. theatres drawing crowds despite pull of streaming

Two theatres in Regina are finding ways to get bums in chairs, despite the ease of streaming movies at home.

What it means for streaming

For those who prefer to watch movies from the comfort of their couch, neither company has explicitly stated their plans for streaming.

In Canada, Warner Bros. Discovery licenses HBO content to Bell Media-owned streaming platform Crave under an exclusive, multi-year deal. Bell has previously stated that Crave remains the “home of HBO and HBO Max programming in Canada.”

It’s not clear if or how a merger would impact Canadian streaming customers who already pay for Netflix and Paramount’s streaming service, Paramount+, and can access HBO content through Crave.

Either way, it could mean more content in one place, whether that’s Netflix or Paramount+.

Oppenheimer director Christopher Nolan, seen backstage at the 2024 DGA Awards in Beverly Hills, Calif., is now the president of the Directors Guild of America. (Chris Pizzello/Invision/The Associated Press)

What it means for jobs

While it’s hard to know exactly what impact this will have on jobs until a deal is firm, industry unions are watching closely.

The Directors Guild of America (DGA) president Christopher Nolan has held discussions with both companies about what consolidation could mean for its members, according to his interview with several trade publications earlier this month, including Deadline.

“A merger is going to mean loss of jobs. It’s going to mean consolidation. We all know that,” the Oppenheimer director said.

“So, whether from Paramount, whether from Netflix, we’re interested in more about the specifics of how they get around these things.”

He also said in the interview that the DGA isn’t ready to pick a side or outright oppose either bid.

What it means for media consolidation

Consolidation of media has become a major point of tension in the deal.

In a statement on Dec. 8 last year, Democratic Sen. Elizabeth Warren called Paramount’s bid “a five-alarm antitrust fire and exactly what our anti-monopoly laws are written to prevent.”

Days earlier, Warren issued a statement calling the proposed Netflix deal an “anti-monopoly nightmare” for the streaming market that could force consumers to pay higher subscription prices.

California Attorney General Rob Bonta released a statement Friday emphasizing the need for antitrust enforcement to protect consumers from further consolidation that he said does not serve the economy, consumers or competition.

“Consolidation of markets has led to increased unaffordability, a loss of good-paying job opportunities and fewer choices for consumers,” he wrote.

Any deal would need approval from the Federal Communications Commission and possible scrutiny from state antitrust regulators.