Kentucky Owl bankruptcy could turn to liquidation of ‘lousy’ bourbon collateral

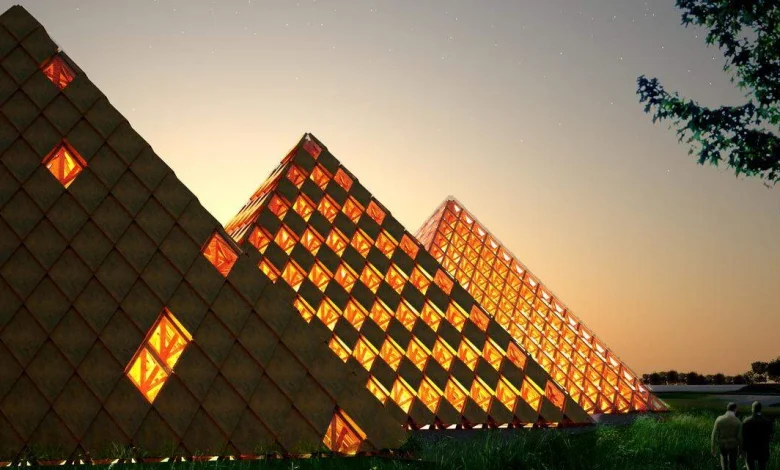

A rendering of the Kentucky Owl Park designs released by Stoli Group from Shigeru Ban Architects, chosen to create the new bourbon distillery and tourist destination in Bardstown. The pyramids were never built and now the assets of the brand could be liquidated.

Premium bourbon brand Kentucky Owl could be headed for liquidation.

Unsecured creditors for Kentucky Owl and owner Stoli Group (USA) on Jan. 15 filed a motion to convert their joint bankruptcy to Chapter 7 liquidation. Kentucky Owl and Stoli USA have been attempting, without success, to reorganize in Chapter 11 bankruptcy since November 2024.

But after more than a year and a failed attempt to come up a reorganization plan that satisfied all creditors, they say the only move left is to liquidate all assets to pay off debts.

A rendering of the Kentucky Owl Park designs released by Stoli Group from Shigeru Ban Architects, chosen to create the new bourbon distillery and tourist destination in Bardstown. The pyramids were never built and now the assets of the brand could be liquidated. Rendering from Shigeru Ban Architects/Stoli Group

However, Fifth Third Bank, the primary secured creditor, is expected to object to the conversion and said they plan to file their own motion to appoint a Chapter 11 trustee to take over.

Separately, Stoli Group and Kentucky Owl also moved for emergency conversion to liquidation on Jan. 14. In a news release, they said the action will not impact its other U.S. and non-U.S. operations, including Louisiana Spirits. Stoli Group blamed a protracted legal dispute with the Russian state as well as a slowdown in teh U.S. spirits market “and a lack of support and flexibility from the Group’s finance partners” for the bankruptcy.

Bardstown Bourbon Company, which has been storing Kentucky Owl’s barrels, said during a Thursday hearing that they were “disappointed” in the move to liquidate.

A hearing on the conversion motions as well as Fifth Third’s expecting filings is set for Jan. 26.

Plan to pay off debt with bourbon barrels failed

Kentucky Owl last August floated a plan to cover $78 million in debt with 35,000 barrels of bourbon and assorted finished whiskey inventory, but lender Fifth Third Bank balked, saying they would be left on the hook for $60 million. After 10 days of hearings, Texas U.S. Bankruptcy Judge Scott W. Everett nixed the plan and asked the parties to keep trying.

The judge cited the “dismal” bourbon barrel market. According to testimony last fall, the market is “frozen,” with a surplus of whiskey inventory that exceeds demand, meaning Kentucky Owl’s supply would only sell with a “considerable discount” that could not cover the bank loan.

Whiskey barrels called ‘lousy collateral’

Now, the committee of unsecured creditors said, they have exhausted every possible scenario and see no way to move forward. The move also comes a day after the chief restructuring officer submitted his resignation.

According to the motion, the 13-month bankruptcy cases “by almost any measure (have been) an abject failure.”

Kentucky Owl Batch 13 released in July 2025 while the brand was in bankruptcy. Provided

The creditors’ committee said Stoli and Kentucky Owl “have been unable to propose a confirmable plan” and the professionals hired by the committee to oversee the process “have mostly gone unpaid since July 2025,” with more than $6 million in fees due so far.

The creditors said they have never met with Stoli conglomerate owner Yuri Shefler, a Russian businessman and self-described oligarch who has refused any discovery in the case.

The creditors said the committee “has ample reason to believe that the Stoli Group (or Mr. Shefler personally) has more than sufficient wherewithal to both finance this bankruptcy and repay all of the Debtors’ debts — they just choose not to.” (Emphasis original to the quotation.)

The creditors’ committee also said they have seen improper payments during the bankruptcy from the debtors to Stoli Group, the international parent of both the US arm and Kentucky Owl, “that may constitute unauthorized takings of estate assets.”

According to the filing, Stoli Group has “a personal vendetta” against Fifth Third Bank for calling the loan default that triggered the bankruptcy.

“Fifth Third Bank has, to be sure, lousy collateral (i.e., liens on cask of unaged whiskey, which is difficult to monetize); Stoli Group strategy has long been to weaponize this collateral weakness,” keeping the case in limbo for more than year. Meanwhile, the value of the bourbon barrels held by Kentucky Owl that are Fifth Third Bank’s collateral have seen a “severe decline in value.”

According to the filing, revenue from the lucrative holiday season fell short, and now “there is simply no basis to believe the situation will improve.”

In September, Schefler, the majority shareholder in Stoli, sent a letter to the judge supporting the failed plan to pay off the bank debt with whiskey. Schefler blamed Russian President Vladimir Putin for a ransomware hack that crippled the company. But Schefler also singled out Fifth Third Bank for tightening its grip on liquidity and forcing the company into bankruptcy.

How Kentucky Owl went from cult bourbon to bankruptcy

Harrodsburg’s Dixon Dedman, whose family owned Beaumont Inn, revived a family-owned label in 2014 with great success using sourced whiskey. The brand became a sought-after favorite among whiskey collectors before it was gobbled up by Luxembourg-based Stoli in 2017 for an undisclosed price.

Kentucky Owl announced plans to build a $150 million architectural “masterpiece” of a distillery and tourism destination in a former Bardstown quarry. But it has never materialized.

The site plan released in 2017 for the Kentucky Owl Park planned by Stoli Group for Bardstown includes a distillery, rickhouses and bottling center on one side a lake, with a convention center, restaurant and visitors center on the other side. Rendering provided

When filing for bankruptcy, the brand cited an August 2024 ransomware attack that froze their data amid geopolitical unrest (the company’s founder is an outspoken critic of Russian President Vladimir Putin’s war on Ukraine) and a downturn in the spirits market.

Wider bourbon industry downturn continues

Besides Kentucky Owl, in the last year Garrard County Distilling shut down, Luca Mariano filed for bankruptcy and Uncle Nearest in Tennessee is in the hands of a receiver.

Now Luca Mariano’s assets, including the distillery and 6,000 barrels of bourbon, are going up for sale to pay of $34.5 million in debts.

Major bourbon brand Jim Beam confirmed in December that it planned to idle its homeplace distillery in Clermont for a whole year as it rebalances whiskey inventory.

An investor group said it has offered to buy out troubled Tennessee whiskey and bourbon brand Uncle Nearest after the distiller defaulted on a $108 million Kentucky loan. New filings under seal in the case could indicate other financial issues.

Major bourbon companies, including Brown-Forman and Diageo, have announced layoffs as whiskey sales have declined due to economic pressures and shrinking demand among younger drinkers.

This story was originally published January 15, 2026 at 12:38 PM.