Latin America’s Perpetual Growth Crisis

In yesterday’s post, I discussed how Mexico has fallen back into the same kind of growth stagnation that defined the years leading up to the pandemic. The fact that Mexico is unable to grow is jarring, because it had a massive investment boom in recent years and exports to the US are doing better than ever. Whatever gains are accruing to Mexico from these things, they’re not going to enough people to really make a difference. Private consumption is back to being very weak, which was also the case before COVID.

In many ways, Mexico is the pointy edge of the sword for Latin America. It borders the US and is part of USMCA, which gives Mexico a huge advantage over its peers in Latin America. So if Mexico can’t grow, what hope is there for the rest of the region? In today’s follow-up post, I look at real per capita GDP across the region. The truth is that no one in Latin America can remotely match US growth, even though the level of development is lower (which should make it easier to grow fast) and many countries are big commodity exporters. That’s damning and in my opinion comes down to poor governance that allows a narrow elite to capture most of the wealth being created.

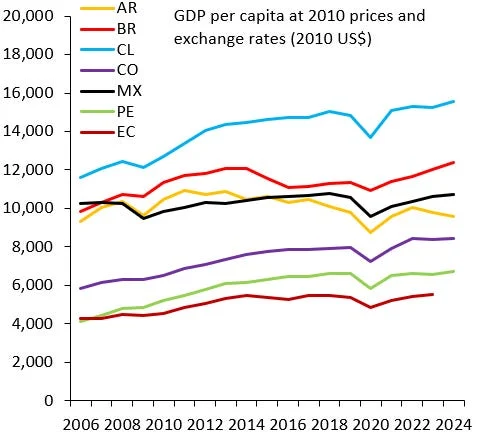

The chart above shows GDP per capita in 2010 prices and exchange rates across seven countries in Latin America. I use per capita GDP because it adjusts for differences in population growth and migration. The last data point for all countries is 2024 except for Ecuador, where the data end in 2023. Generally speaking, it’s remarkable how little progress there’s been across the region in the 18 years from 2006 to 2024.

The chart above is exactly the same as the first one, except that it adds per capita GDP in 2010 prices for the US. The disparity in per capita GDP levels is shocking and there is no sign that countries in Latin America are converging towards the US. If anything, the opposite is true. They’re falling further and further behind the US.

The chart above shows growth in per capita GDP between 2014 and 2024. There’s a couple of points worth making. First, no one comes remotely close to the US, which grew a cumulative 20 percent in that decade, i.e. two percent per year. Second, there are three groups of countries in Latin America: (i) Colombia (CO), Peru (PE) and Chile (CL); (ii) Mexico (MX) and Brazil (BR); and (iii) Ecuador (EC) and Argentina (AR). The first group has done reasonably well compared to the rest of the region, but still falls substantially short of the US. The second group should be doing much better and it’s here that the growth puzzle is most vexing and profound. The third group is countries that insist on pegging to the Dollar (Ecuador’s dollarization is really just an extreme version of a Dollar peg), which kills any hope for growth, something I’ve written on extensively in the case of Argentina.

Latin America is in a perpetual growth crisis. That crisis is most acute for Mexico and Brazil, which both have flexible exchange rates and thus aren’t committing the kind of growth hara-kiri that Argentina insists on doing. Both Mexico and Brazil should be doing so much better.