India, China, South Africa, other BRICS nations to explore digital currency link to crush dollar

According to two sources familiar with the discussions, the Reserve Bank of India (RBI) has recommended that the proposal be placed on the agenda of the 2026 BRICS summit, which India is set to host later this year.

If accepted, it would mark the first time the bloc formally considers connecting central bank digital currencies (CBDCs) across member states.

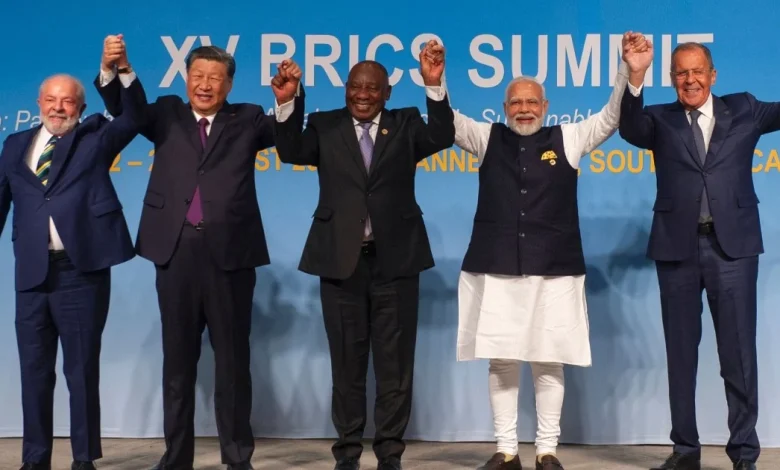

The BRICS grouping, originally comprising Brazil, Russia, India, China, and South Africa, has expanded in recent years to include countries such as the United Arab Emirates, Iran, and Indonesia.

The RBI’s proposal is understood to focus on facilitating cross-border trade finance and tourism payments by making national digital currencies interoperable.

Central banks in China, Brazil, and Russia did not respond to requests for comment, while South Africa’s central bank declined to comment. India’s central government also did not respond.

The RBI has publicly stated that it is keen to link the e-rupee with other CBDCs to boost efficiency and expand the currency’s international use, while insisting that this is not a de-dollarisation drive.

None of the major BRICS economies has fully launched a retail CBDC, but all are running pilot programmes. India’s e-rupee, introduced in December 2022, has attracted about seven million retail users. China has also signalled plans to expand the international use of its digital yuan.

To encourage adoption, the RBI has enabled offline payments, added programmability for government subsidy transfers, and allowed fintech firms to offer digital currency wallets.

However, one of the sources cautioned that making BRICS CBDCs interoperable would require agreement on technology standards, governance rules, and mechanisms to settle trade imbalances.

One option under discussion is bilateral foreign exchange swaps between central banks. These could allow weekly or monthly settlements while managing uneven trade flows.

Previous attempts by India and Russia to increase trade in local currencies faced challenges after Russia accumulated large rupee balances with limited use, prompting India to allow such funds to be invested in local bonds.

The renewed interest in CBDCs comes despite growing global enthusiasm for stablecoins. India has taken a sceptical stance, arguing that stablecoins pose risks to monetary stability.

RBI Deputy Governor T Rabi Sankar said recently that CBDCs “do not pose many of the risks associated with stablecoins”, citing concerns over monetary control and systemic resilience.