Nvidia’s not investing $100 billion in OpenAI because the chip designer doesn’t want to pay the OpenAI valuation tax

The Wall Street Journal dropped a bombshell on Friday evening, reporting that Nvidia’s plan to invest up to $100 billion in OpenAI “has stalled after some inside the chip giant expressed doubts about the deal, people familiar with the matter said.”

In September, the two sides announced a non-binding letter of intent which would see OpenAI lease chips from Nvidia as the parties built out 10 gigawatts of computing power, with the chip designer investing in the ChatGPT maker “progressively as each gigawatt is deployed.”

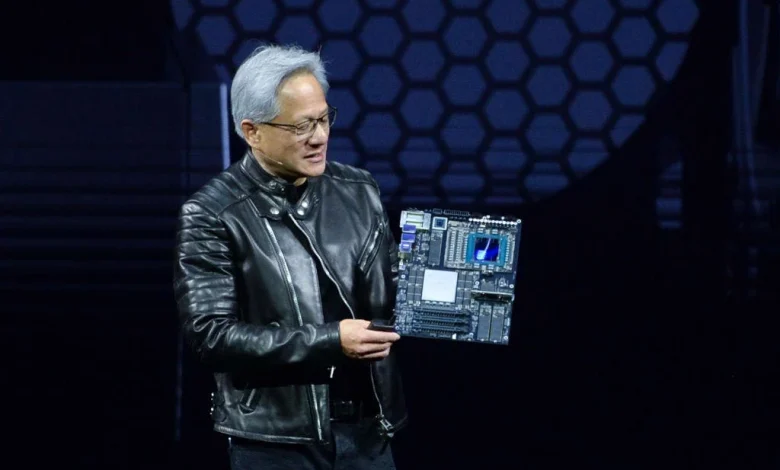

This weekend, Nvidia CEO Jensen Huang told the press that the $100 billion OpenAI investment was “never a commitment,” effectively confirming this report.

The WSJ indicated that Huang “has also privately criticized what he has described as a lack of discipline in OpenAI’s business approach and expressed concern about the competition it faces from the likes of Google and Anthropic, some of the people said.”

The simple takeaway here: Nvidia wants the world to know that they are not going to be over-reliant on OpenAI.

Nvidia does not want to pay the OpenAI valuation tax.

Jensen Huang can take the market’s pulse. He definitely keeps up with the memes, at least. Companies whose future revenues are seen as too dependent on the ChatGPT maker get punished for that.

This was a contributing factor to one of Microsoft’s biggest one-day drops on record and the reason why Oracle’s credit default swap spreads are something we talk about once every couple weeks.

That being said, Nvidia will “absolutely be involved” in OpenAI’s current funding round, per Huang, who said it would be “probably the largest investment we’ve ever made.”

(For reference, Nvidia has invested $5 billion in Intel.)

And why not? Nvidia continues to generate more and more cash flows despite both buybacks and capex running at records. The chip designer has a vested interest in supporting different parts of the AI supply chain, and the easy ability to do so.

But management also has a vested interest in making sure that the company continues to be viewed as the AI winner whose coattails other tech firms look to ride, rather than a giant whose dominant position may be threatened by the company they keep.

Zooming out, the very ambitious partnership between Nvidia and OpenAI had clearly stalled by the simple fact that there was no progress. In their September announcement, the companies said they were looking to finalizing the details “in the coming weeks.” It’s February.

And the $100 billion figure is something Nvidia had been shying away from in particular. Both the Q3 10-Q filing and CFO Colette Kress on the earnings call referenced an “opportunity” to invest in OpenAI; neither used the $100 billion figure, in stark contrast to the more formalized agreement to pour $10 billion into Anthropic.

The filing, in particular, noted that “There is no assurance that we will enter into definitive agreements with respect to the OpenAI opportunity or other potential investments, or that any investment will be completed on expected terms, if at all.”