Japan in Crisis – Robin J Brooks

Against the US Dollar, the Japanese Yen is closing in on the lows it reached in 2024. In trade-weighted terms, the Yen is actually already weaker than it was then, because its current depreciation is against a Dollar that’s much weaker than back in 2024. It’s tempting to think that official intervention will stop this slide and Japan’s Ministry of Finance (MoF) is making noises in that direction. But any intervention will be just as ineffective as in the past. The Yen is falling because markets want to see interest rates rise, which are still at artificially low levels and don’t compensate investors enough for what they see as rising risk of default. Unfortunately, while higher interest rates may stabilize the Yen, they risk pushing Japan into a fiscal crisis. Japan is trapped.

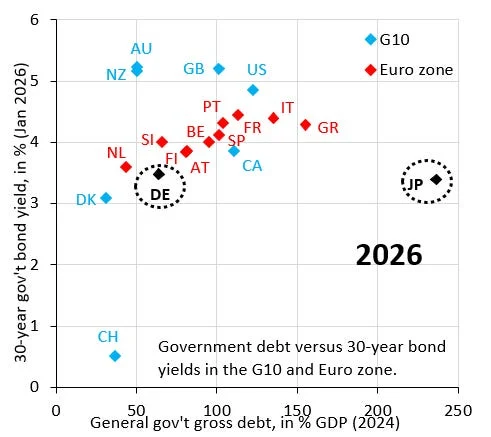

The chart above is one I show frequently and highlights the crux of the problem. It plots gross government debt on the horizontal axis and the 30-year government bond yield on the vertical axis. Japan’s yields have been rising quickly, but they’re still much too low relative to its monstrous level of government debt. The easiest way to see this is to compare Japan (JP) to Germany (DE). German debt is far below that of Japan, but its 30-year yield is actually slightly above Japan. Ongoing purchases of government debt by the Bank of Japan (BoJ) are preventing yields from rising to the level markets want to see. As long as yields are kept artificially low, depreciation pressure on the Yen will persist regardless of whether there’s official FX intervention or not.

Of course, allowing yields to rise is a poisoned chalice, because it risks pushing Japan into a fiscal crisis. Japan quite simply can’t afford for the BoJ to step back from buying bonds entirely, because no one knows how far yields may rise. There is a way out from this conundrum, however. As I noted in this post, Japan’s net debt is far below gross debt, because Japan’s government holds lots of assets. The way forward for Japan is to sell some of those assets and use the proceeds to reduce gross government debt.

Japan’s net debt stands at 130 percent of GDP versus gross debt around 240 percent. Much of this is illiquid and can’t be sold at short notice. But even a gesture in this direction will make a big difference for the Yen. This is the way forward for Japan. Not official FX intervention, which will be just as ineffective as in the past.